5 FACTORS TO CONSIDER WHEN

EVALUATING A FINTECH STARTUP

The first quarter of 2021 brought global fintech startups investments accounting for $22.8B, states CBInsights.

This number is beating the previous record captured in Q2 2018. The surprisingly large wave of funding in 2021 caused a boom of emerging fintech unicorns at the beginning of this year. Some of this quarter’s highlights are the German SaaS cloud banking platform Mambu and Austrian BitPanda that is a cryptocurrency investment unicorn.

The ongoing processes of digitalization have strongly affected the financial sector and has given rise to small agile stratups to offer new and much demanded products and services.

Today startups are injecting technology in all areas of finance. This includes payments, banking, lending, wealth management, real estate and insurance. What is truly impressive is that what was previously the arena of large corporates with tens of thousands of employees is now being conquered by small online platforms. An excellent example is the UK’s newly emerged unicorn Startling offers private and business bank accounts which can be managed fully by the Starling app. Starling has already gained the title of the “Britain’s Best Bank 2020”.

This great success of online banking goes in line with Bill Gates’ famous quote

“Banking is necessary, banks are not”.

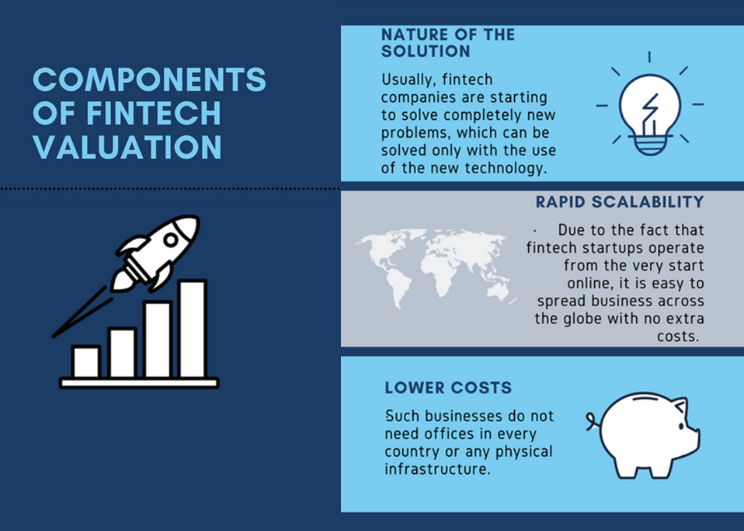

However, the fintech space has its very unique specifications that makes it considerably different from other start-up areas. The distinction makes the valuation process of the fintech startups vary as well. To understand how to evaluate such a business, we need to acknowledge the components of the fintech valuation.

What makes fintech startups so unique?

Source: Toptal

Having these three main points in mind, we have derived the top 5 factors to consider when evaluating a fintech startup:

- Relevance of the Solution – Does a startup offer a completely new solution to a financial problem or it is improving the existing one? Is the idea viable?

- Founders’ Focus – Are the founders focused on the monetization of the idea? Are they passionate?

- The revenue structure of the company – What is the revenue model? In fintech startups, revenues and profits can grow unevenly. So, while revenues are increasing due to a growing number of customers, profits can still be small. A company should have a prepared plan of how they are going to monetize the business in the long run.

- Possible additional services – Are there any expanding opportunities? Can the business create any additional revenue lines?

- Risk identification – What are the potential risks to the business? Are there any regulatory risks?

What methods to use to evaluate a fintech startup?

Some of the most popular methods used by VCs and angles are:

- The Payne Scorecard Method

- The Berkus Method

- The Venture Capital Method

- The First Chicago method

However, firms and individual investors often amend these methods so they can leverage their expertise and reflect upon the current market and company dynamics. If you would like to get a more comprehensive overview of startup methods, you can have a look at our Overview of the Startup Methods.

These methods will be helpful for the valuation of fintech startups, however as mentioned they need to be amended to the current circumstances as well as the investors expertise and risk preferences. Additionally, the further growth of the business makes the process of valuation more complicated.

With DealMatrix startup valuation becomes easy. DealMatrix offers a data-engine that uses deep market data for a clearer valuation.

![Startup Growth Pains: How To Handle Them? [Tips For Startup Founders]](https://dealmatrix.com/wp-content/uploads/2021/11/DM_Blog_Images-13-500x383.png)