VENIONAIRE DEALMATRIX MULTIPLES

Valuation Multiples Built for

Private Markets

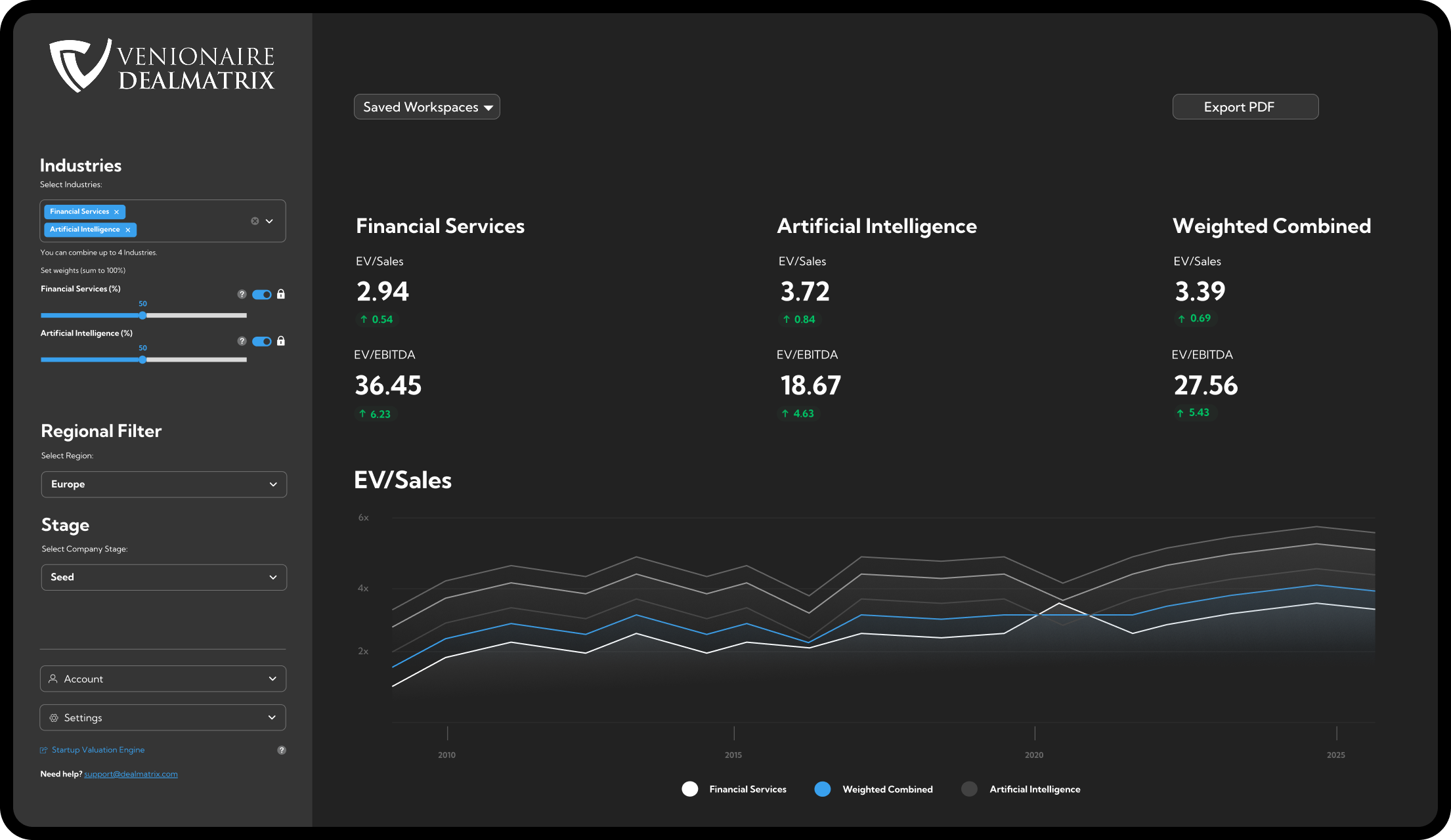

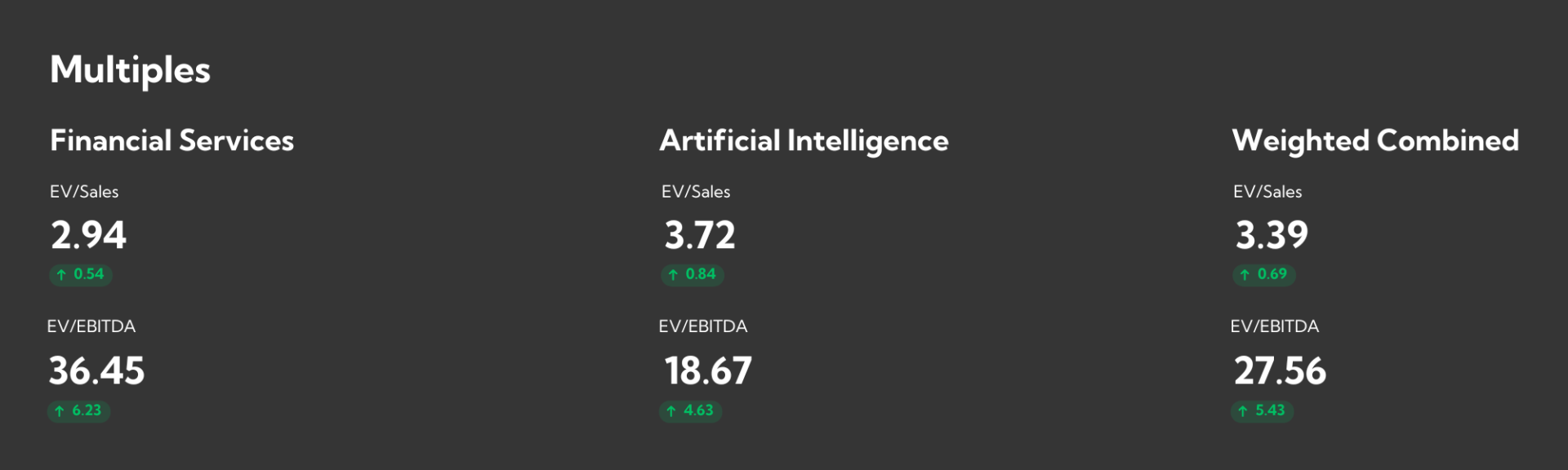

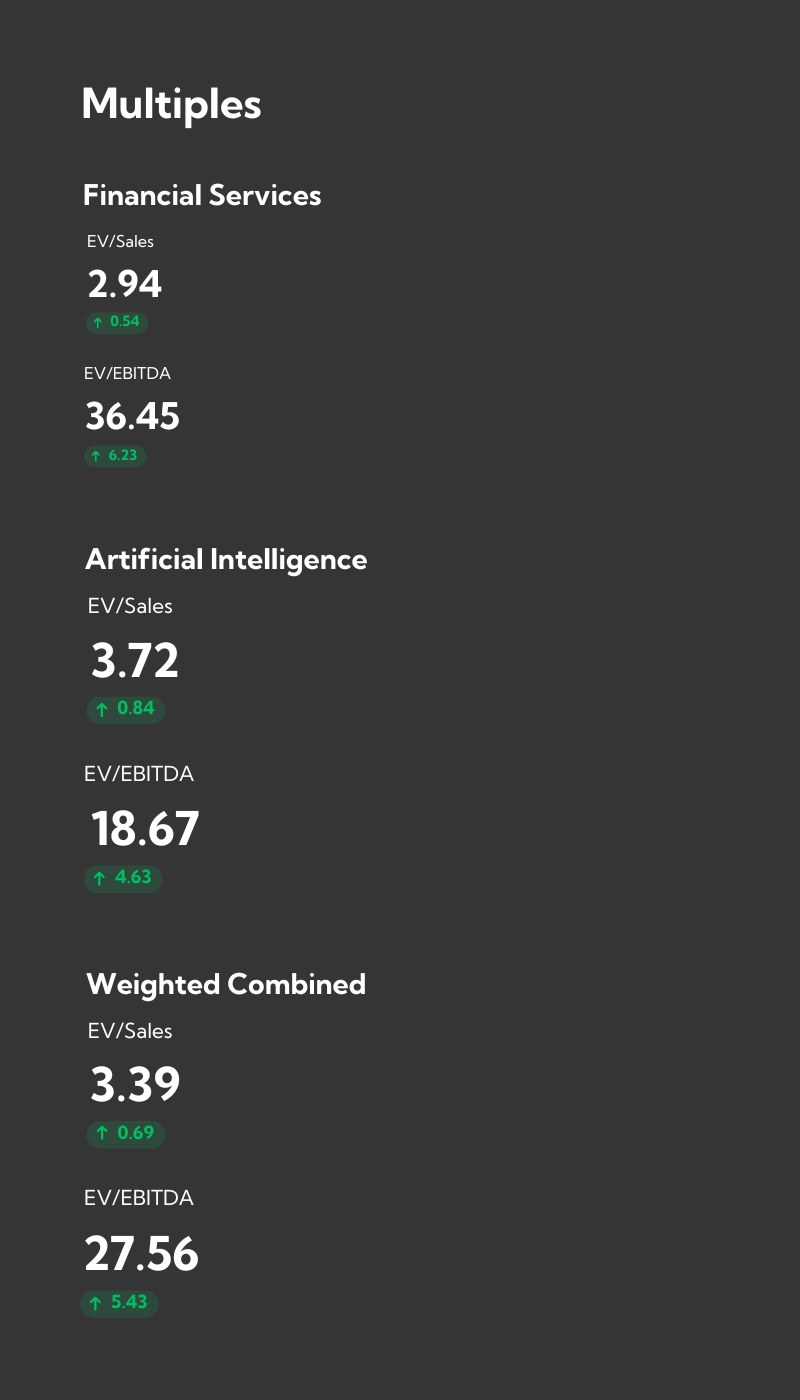

Time-series-based EV/Sales & EV/EBITDA multiples, tailored by sector, stage, and region for private markets.

Track record of leading companies and events

BENEFITS

The private equity/venture capital multiples gap — closed.

A smarter way to benchmark valuations of private companies.

Granular Coverage

Breakdown by Sector, Stage & Region

Sector, stage, and region filters for context-specific multiples.

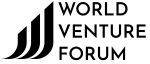

Weight Assignment

Precise Weight Assignment

Assign weights across sectors and generate a weighted average multiple tailored to your deal.

Time-Series-Based

Time-Series-Based

You can compare private-company EV/Sales and EV/EBITDA multiples over a time series of 20 years.

Select your sector & assign weights.

Choose your sector focus and apply custom weights to build a multiple that reflects your specific deal.

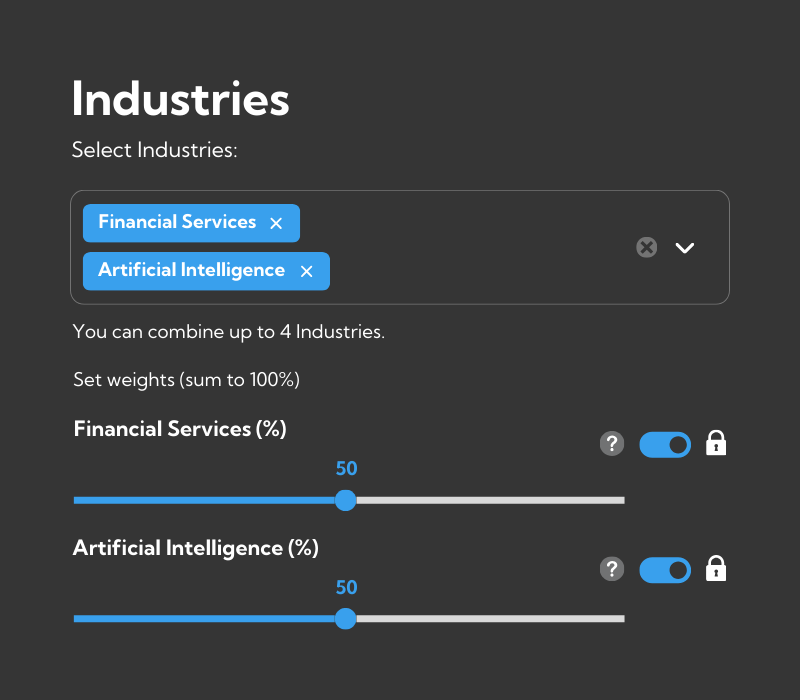

Select your region & stage.

Select the region and company stage to get multiples tailored to the exact market context you’re analyzing.

Receive and download multiples.

Download your tailored private multiples in one click.

*illustration purposes only

TRUSTED PARTNER

This is why analysts rely on us.

Confidence built into every multiple we deliver.

Robust Analytical Framework

Our proprietary engine is trained using our internal research and data and also integrates market-based valuation metrics with macroeconomic indicators, reflecting not only sector-specific trends but also the underlying economic context influencing the private equity landscape.

Trusted Data Sources

We base our analysis on internationally recognized financial and macroeconomic datasets, ensuring that all inputs come from reliable and authoritative institutions.

Quality Assurance

Outlier detection and systematic adjustments are applied to enhance consistency and reduce statistical distortions, ensuring that the results remain practical and applicable across diverse contexts.

FAQ

The most asked questions answered here.

Where is the data coming from?

DealMatrix Multiples is built on a combination of public market data, macroeconomic indicators, and proprietary valuation and transaction datasets.

Publicly available capital market data provides the baseline for peer group analysis. This is systematically enriched with macro-economic variables and, most importantly, with proprietary data accumulated over years of Private Equity, Venture Capital, and M&A work by Venionaire and its DealMatrix team.

The result is not a simple aggregation of data, but a curated and contextualized valuation dataset.

How do you select and curate the data?

Data selection follows a rigorous, structured process:

Extraction of financial and economic data from high-quality, industry-standard sources enriched with a proprietary data foundation built and continuously refined by Venionaire DealMatrix over many years through Private Equity, Venture Capital, and M&A mandates.

Transformation to ensure compatibility which includes log transformations and aggregation by region.

Segmentation into EV/Sales and EV/EBITDA analytical streams.

Using mixed linear models to construct the proprietary Venionaire DealMatrix multiple, combining actual market observations, model-predicted values, and a conservative lower bound.

Final quality control, where anomalies and outliers are addressed to enhance reliability.

This workflow ensures the output is statistically solid, transparent, and valuation-ready.

How do you ensure data accuracy?

We ensure data accuracy through a multi-layered quality and modeling process:

Use of authoritative data sources for both financial and macroeconomic information.

Systematic data transformation, including logarithmic adjustments, frequency standardization, and regional aggregation, to reduce statistical noise.

Econometric mixed linear models that incorporate fixed (time and sector) and random (regional) effects, capturing complex interactions between markets and economic conditions.

Post-model validation, including correction of implausible values (e.g., negatives) and identification and treatment of statistical outliers.

These steps collectively ensure that our multiples are consistent, robust, and suitable for real-world valuation work.

How wide is the coverage?

Our coverage spans:

140+ industries,

Company stages (Pre-seed – Series E),

Major global regions,

supported by extensive macroeconomic datasets and market valuation inputs.

This allows us to deliver granular Private Equity multiples tailored to sector, phase, and geographic context.

Why use the Multiples App by Venionaire DealMatrix?

Because it goes beyond generic multiple databases.

DealMatrix Multiples combines:

Years of proprietary data collection

A proprietary valuation model

Deep capital-market and transaction expertise

Instead of static benchmarks, users receive market-realistic valuation ranges that reflect current conditions and transaction logic.

In short:

DealMatrix Multiples is built by practitioners, for practitioners.

Startup Valuation Engine

We enable startups to evaluate their company and generate a valuation report. Our cutting-edge matching technology then ensures optimal partnerships with investors, fostering growth and innovation.

Whether you’re seeking investment opportunities or just aiming to have a fact-based startup evaluation, the Startup Valuation Engine is your bridge to success.

DEALS MONITOR

The hottest deals in the spotlight

In the Deals Monitor, our analysts research the hottest deals to separate signal from noise and surface transactions that truly matter for dealmakers & investors.

PLD Space

Spain’s PLD Space raises €180M to scale satellite launch infrastructure

- Deal of the Week

Wayve

Wayve secures $1.5B to deploy its global autonomy platform

- Deal of the Month

Q.ANT

Stuttgart’s Q.ANT raises €62M to scale energy-efficient photonic processors for AI and high-performance computing

- Deal of the Year