TOP EUROPEAN DEALS

IN NOVEMBER 2021

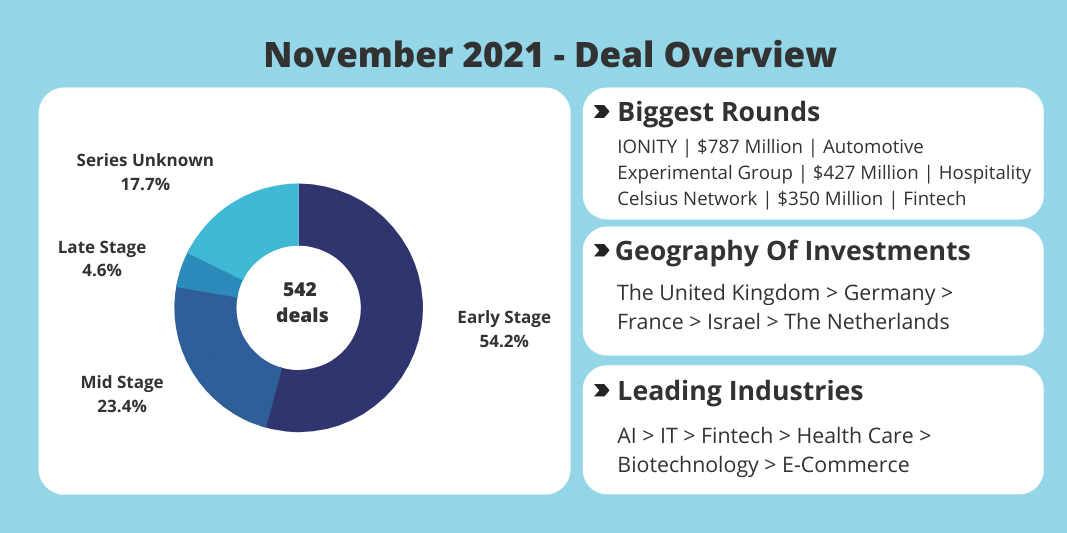

The European deal highlights of this month are IONITY, an electrical vehicle fast-charging stations provider, Experimental Group, a Paris-based hotel group, and Celsius Network, a crypto lending platform. They have raised $787 million, $427 million, and $350 million respectively. Moreover, three startups have achieved unicorn status, namely Shift Technology, Thought Machine and Motorway.

We have analysed Deals Monitor’s news in November and selected the three most booming industries in Europe. Artificial Intelligence, Information Technology and Fintech seem to hit all records this month.

Most of the deals are distributed between four prominent startup hubs situated in the United Kingdom, Germany, France, and Israel. A superior number of deals is closed during early stage (54.2%) and mid stage rounds (23.4%).

If you’re interested in keeping track of the recent announcements in the startup world, subscribe to our monthly newsletter to receive these updates straight to your inbox.

Top European Deals in October 2021 – Deals Monitor

- IONITY | $787M | Germany | DealMatrix’s Awarded Deal of the Week #47

Munich-based electric vehicle fast-charging network provider has secured $787 million for its planned expansion across Europe. The company aims to provide 7000 new charging points by 2025, which is four times more than the existing amount of 1500 stations. They intend to have from 6 to 12 charging stations per location and additional points may be created in high-demand areas.

Read about the highlights of each week in our regularly updated section “Deal of the Week”

- Experimental Group | $427M | France

The French hotel group has raised $427 million of funding to accelerate its presence in the world. The company plans some strategic acquisitions in the coming years to become a worldwide accommodation provider. The Experimental Group has a sustainable approach to the hotel business. It aims to preserve a spirit of discovery, which is the key value of the group.

- Celsius Network | $350M | Valued at over $3.25B | the UK

A centralised crypto lending platform headquartered in the UK has received an additional $350 million to its recent Series B round. It has resulted in a $3.25 billion valuation. The capital raised will be used for product line expansions, development of the current projects and entering new markets. The company also intends to fund green Bitcoin mining. Last June it spent $200 million on that.

- Collibra | $250M | Valued at over $5.25B | Belgium

Belgian data intelligence company has raised $250 million in Series G funding round. It ended up with a $5.25 billion post-money valuation, which is double the last year’s number. The investment will be spent on expansion across the United States, Australia, Europe and the Middle East. Additionally, the company wants to double its workforce and invest in R&D to create new features for its offerings.

- Shift Technology | $220M | Valued at over $1B | France

French AI-based tools provider has closed Series D round with $220 million. Its artificial intelligence solutions help fight insurance frauds. The new capital will be deployed to enter the health market, as well as to expand in existing ones, like property and causality markets. The company operates in a booming market for insurance fraud detection technology that was estimated to be worth $8 billion by 2024.

- ConsenSys | $200M | Valued at over $3B | Switzerland | DealMatrix’s Awarded Deal of The Week #46

Blockchain software technology company has secured $200M for its team expansion. The company’s Chief Strategy Officer says that there is a talent war on the Ethereum front. ConsenSys has three main products, namely MetaMask with 21 million users, Infura with 350 thousand developers and the last year acquired Truffle. MetaMask and Infura remain to be the main innovation engines of the business.

- Thought Machine | $200M | Valued at over $1B | the UK

London-based seller of cloud B2B banking services has raised $200 million in Series C financing round. After this investment, the company has achieved unicorn status, with a valuation of over $1 billion. The newly acquired funding will be spent on further development and improvement of its SaaS product Vault. Vault is a cloud-based platform that performs various retail banking services.

- Motorway | $190M | Valued at over $1B | the UK

A newly emerged British unicorn secures $190 million in Series C financing. Motorway is a fast-growing second-hand car auction platform. The market for used cars is booming due to the lack of supply of computer chips for new cars. The company plans to invest the money in scaling the business.

- Accel Club | $170M | Valued at over $9B | the Netherlands

An Amsterdam-based platform for buying, operating, and launching E-commerce businesses has closed Series A round with $170 million. The startup aims to enable the fast growth of e-commerce brands with the help of the technology, tools and resources provided by its platform. The demand for such a platform can be explained by an increasing amount of consumption that is going online.

- Plastic Energy | $168M | the UK

A London-based global leader in chemical recycling has raised $168 million to accelerate its growth and expand the existing technology portfolio of recycling plants. The success of the company lies in the signing of an agreement with key players in the chemical sector. Moreover, its recycled plastic is already being used for packaging by Unilever and Tupperware.

A Closing Word

By keeping track of the largest deals in Europe, we also see how ecosystems change. Besides the stable prominent sectors like AI, IT and Fintech, there are new booming areas, like used-car marketplaces or fast-charging stations.

![Startup Growth Pains: How To Handle Them? [Tips For Startup Founders]](https://dealmatrix.com/wp-content/uploads/2021/11/DM_Blog_Images-13-500x383.png)