TOP EUROPEAN DEALS

IN Q3 2021

The third quarter of 2021 has come to an end, and we are thrilled to sum up the results of these three months. By analysing both Deals Monitor and Crunchbase we aimed to find out whether this quarter was as impressive as Q2. To do so, we have had a look at the most spectacular rounds closed in Europe, the most promising industries and striving startup hubs.

Without further ado, let’s see how the Investment Deals Activity in Q3 has evolved.

European Funding Landscape

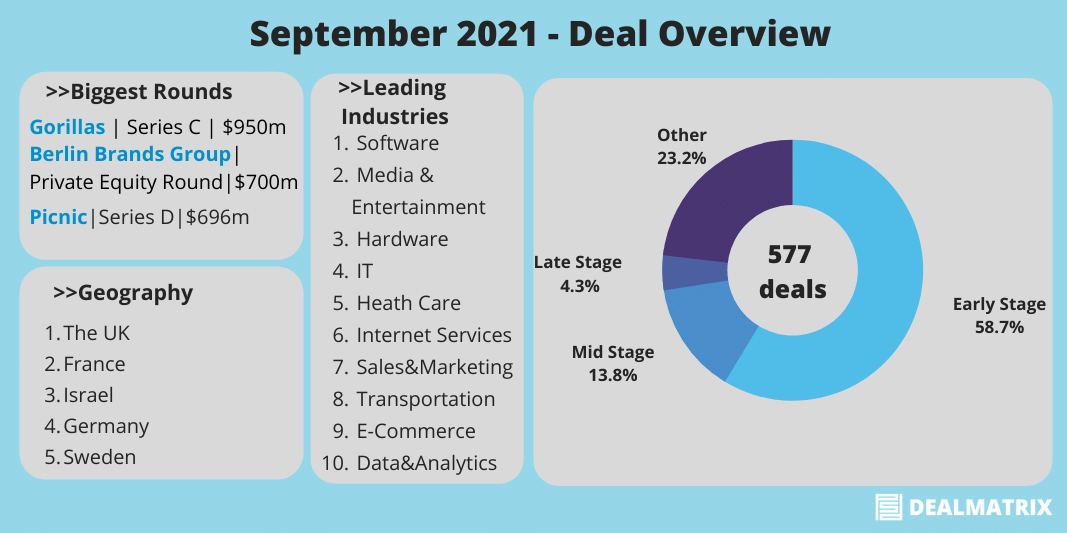

While this quarter shows an impressive amount of money raised (28B) USD, it did not beat the previous quarters’ total money raised. The number of deals closed is also lower than in the previous quarter, with 1,674 deals being closed in Q3 2021.

As one would expect, the largest number of deals took place in seed rounds. Overall, 18.2% out of all funding rounds were allocated to Pre-Seed rounds, followed by 35.1% Seed rounds, 12.1% Series A with the rest of the share consisting of later rounds. It should be noted that information about Seed rounds tends to lag behind, thus we expect seed rounds to make up more than stated at this moment.

Leading Industries by number of deals

It might come as no surprise that the Software industry is still the absolute leader in both number of deals and the funding volume. FinTech funding closely follows suit, RetailTech trailing closely behind. One surprising sector is the Healthcare sector, which shows lesser deals being made as well as a halving in a total amount of funding obtained. It should be noted that Q2 of 2021 was an extreme outlier when compared to previous quarters, however other regions around the world are showing an increase in this sector.

Geography of investments

The UK keeps its strong position in the startup hubs arena. One of the most remarkable London-based startup Revolute has raised $800 million in Series E round. The company specializes in mobile banking and foreign exchanges.

Germany and France have started to attract greater capital for their mega-deals. The Netherlands and Sweden are perceived to be promising startup hubs, which are hosting more and more innovative businesses each month.

Top 10 European Deals in Q3 – Deals Monitor

- Trendyol | $1.5B | Valued at $16.5B | Turkey

Turkey’s e-commerce platform has received $1.5 billion in the private equity round. The company is the first to receive a decacorn status in Turkey. The current valuation of Trendyol accounts for $16.5 billion. The capital gain is going to be spent on global expansion, as well as within the country.

- Gorillas | $950M | Valued at $3B | Germany

Berlin-based grocery delivery startup has secured $950 million in Series C financing round. The post-money valuation has reached $3 billion after this investment. The cash received will be used for acceleration in Europe, especially in France and Spain.

- Revolut | $800M | Valued at $33.2B | the UK

The British fintech startup has closed Series E round with $800 million. The company is now being valued at $33.2 billion. According to Techcrunch, the acquired investments will go on expansion in the U.S. and India, as well as on adding new innovative features to the Revolut App.

- Bolt | $693.5M | Valued at $4.6B| Estonia

Tallinn-based mobility company has raised $693.5 million in Series E round. This investment pushed the startup’s valuation to $4.6 billion. Bolt aims to become a multifunction transport app that includes mobility services like a scooter, taxi or bike, and food delivery.

- Picnic | $693.5M | The Netherlands

The Dutch online grocery service has received $693.5 million of funding in the Series D financing round. Picnic is delivering groceries directly from the distribution centres to the doorsteps. The company intends to invest in expansion to Germany and France. It also aims to make its fulfilment centres more efficient and increase the use of electric vehicles.

- Berlin Brands Group | $700M | Valued at $1B or more | Germany

Berlin-based e-commerce startup has secured $700 million in a private equity round. After this deal, the company gained unicorn status. The raised capital is going to be used in tech platform expansion and international logistics network improvement.

- Sorare | $680M | Valued at $4.3B | France

Fantasy football platform Sorare raised $680 million in a Series B funding round, giving it a valuation of $4.3 billion. The company intends to use the funds to accelerate growth within the football vertical, but also expands its offering into other sports sectors.

- Octopus Energy | $655M | Valued at $4.6B | the UK

London-based energy technology startup has closed Series A round with $655 million funding. The cash will be spent on the fulfilment of the startup’s mission: promotion of renewables and sustainable technology to end the reliance on fossil fuels.

- Mirakl | $555M | Valued at $3.5B | France

The French marketplace platform has secured $555 million in a Series E funding round. The post-money valuation reached $3.5 billion. The company intends to use the funds to enlarge engineering and customer success teams.

- CarNext | $462.3M | The Netherlands

Europe’s leading used-car marketplace has raised $462.3 million to accelerate its growth across the European countries. Previously the startup was a part of the LeasePlan company, but since 2021 it has become an independent business. CarNext administrates used-car transactions between B2C and B2B customers.

Conclusion

The investment landscape seems to be thriving, even though the total amount of funding and the number of deals has decreased from last quarters all-time high. So far , the total amount of funding in 2021 has already significantly exceeded 2020. Furthermore, we can see that the European start-up environment is maturing, with countries like France and Germany showing promising growth, with the UK keeping its top spot as the European start-up hub.

![Startup Growth Pains: How To Handle Them? [Tips For Startup Founders]](https://dealmatrix.com/wp-content/uploads/2021/11/DM_Blog_Images-13-500x383.png)