STARTUP INSIGHTS &

TRENDS FOR 2021

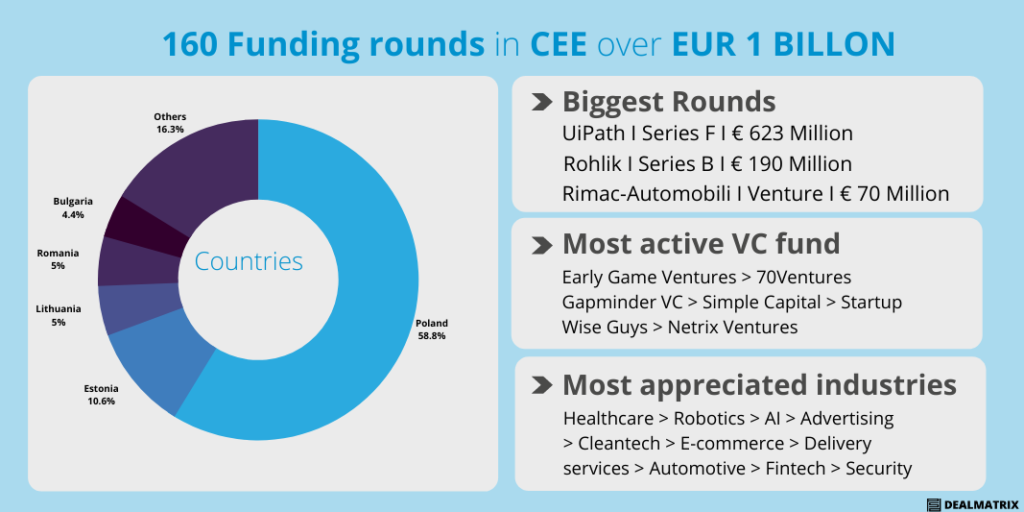

The investment world is definitely in a bull market. In the 1st quarter of 2021, 160 investment rounds were closed in Central and Eastern Europe, while only 71 were fully disclosed in terms of amount, month, participating investors and company details.

MOST WANTED STARTUP-INSIGHTS

♦ Most wanted sectors

According to the VC Funding CEE Report the most recognizable sectors in Q1 were mainly:

- Healthcare

- Robotics

- Advertising

- AI

- Cleantech

- E-commerce

- Delivery services

- Automotiv

- Fintech

- Security

To sum up its obviously that these sectors seems to be extremely resilience to the COVID19 pandemic and as a result the investors focused more on these.

♦ Investments in funding rounds

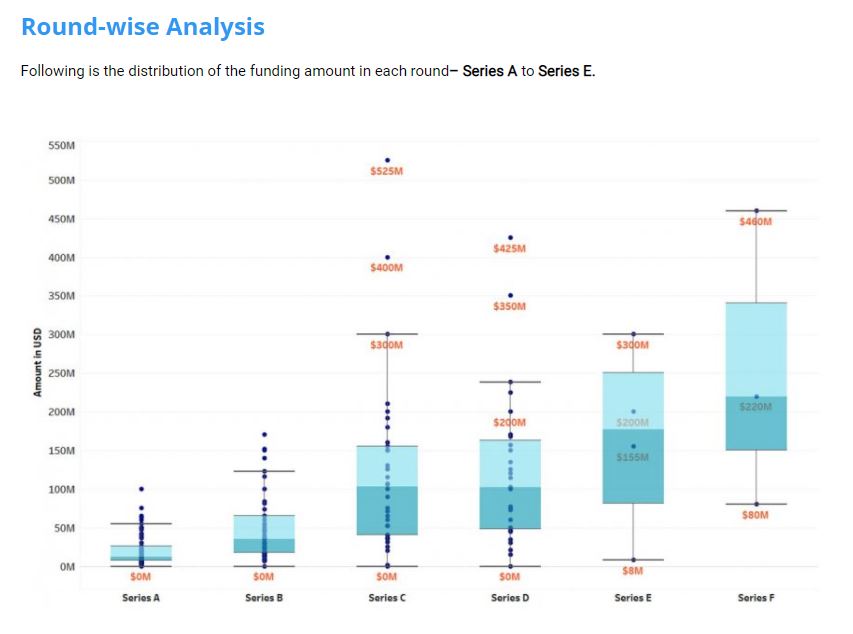

Venture funding in the USA is up 74%, and in Europe is up 37% percent compared to Q4 2020. Deal value in Europe amounted to $19 billion and the USA topped $68 billion, which is over 2x above last year’s Q1 for both continents, so intellizence. In the following graph you can the distribution of the different funding-rounds.

TRENDS TO BE AWARE OF

- The total value of the biotech industry is around $295 billion. Further growth is expected in 2021 due to the development of DNA analysis technologies.

- The average investment in African tech startups in 2019 was $48 million. More and more venture capital companies are investing in Africa each year. The average investment per startup in 2015 was $25.3 million, which means that the investment level has grown by almost 100%. However, only about 20% of those companies have local founders.

- The entire Green Technology and Sustainability market size is expected to reach $28.9 billion by 2024.

- No-code startups reach a 100% increase in searches in 2018. The interest in no-code startups spiked in 2018, and from there, it has stayed steady. Companies are looking for customizable digital products that they can adjust to their needs.

- The sharing economy market is expected to reach a total sales revenue of $335 billion by 2025. In just a few years, sharing economy startups like Airbnb and Uber have grown exponentially and established a global presence. At the moment, Airbnb is worth $24 billion, and Uber is valued at over $50 billion.

- 60% of entrepreneurs agree that AI is currently the most promising innovation technology. Not only that, but they also agree that it will be the most promising technology over the next 10 years. The areas of this technology with the most potential are autonomous transportation and big data.

- From 2010 to 2018, startup valuation grew by 11.2% CAGR for seed valuations, 15% for series B, and 16.2% for Series A.

- Only 1 of 100 startups that raised seed rounds were able to reach a valuation of $1 billion.

- The highest-valued private startup in the world is Bytedance (Toutiao), from China, worth around $75 billion.

- The total value of the biotech industry is around $295 billion. Further growth is expected in 2021 due to the development of DNA analysis technologies.

- The most valuable unicorn company in the world, ANT Financial, is valued at over $150 billion.

CONCLUSION

We are excited about market data, which is why we have shared these important numbers and trends about startups. The startup industry will continue to be the driving factor for global innovation and business growth for many years. However, companies need to learn how to adjust to trends while being sustainable and efficient so that more startups can survive long term.

To stay up to date with startup valuation trends and news of the latest funding rounds, bookmark the DealMatrix Deals Monitor.

![Startup Growth Pains: How To Handle Them? [Tips For Startup Founders]](https://dealmatrix.com/wp-content/uploads/2021/11/DM_Blog_Images-13-500x383.png)