STARTUP VALUATION

The Payne Scorecard Method

Pre-seed companies often lack a minimum viable product, relying instead on an evolving business concept that may change frequently in the first 18 to 24 months as they seek an initial product-market fit. At this stage, financial plans and projections offer limited value. Nevertheless, business angels use valuation models to assess these early-stage startups, with the Scorecard Method being one of the most notable approaches.

Developed by Bill Payne, this top-down approach evaluates a startup by comparing it to other startups at the same stage within a particular geographic region and industry (such as regtech, digital health, fintech, or SaaS). Investors use this method to benchmark the “standard” value of pre-seed or early-seed companies.

Step 1 - Average Startup Valuation

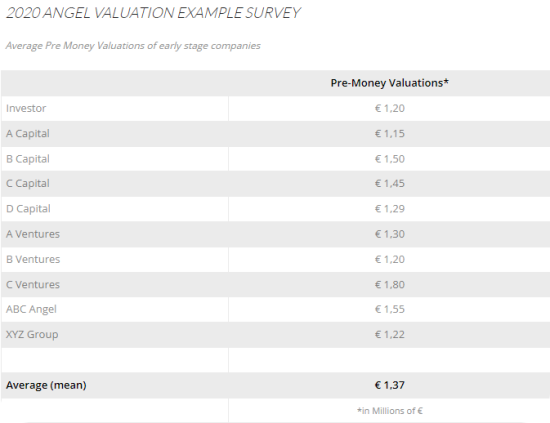

First, we need to determine the average valuation of similar startups in our region. Databases like Crunchbase or AngelList, or consulting Angel Clubs, can provide valuable insights for this.

Keep in mind that markets are fluid, so valuations can fluctuate over time—for instance, recent crises have significantly affected valuations. We advise collecting extensive data on recent investments in startups within the same industry, region, and stage.

Here, we have calculated an example of average valuations based on fictional angel groups and investors for startups meeting the specified criteria:

Step 2 - Determine Factors

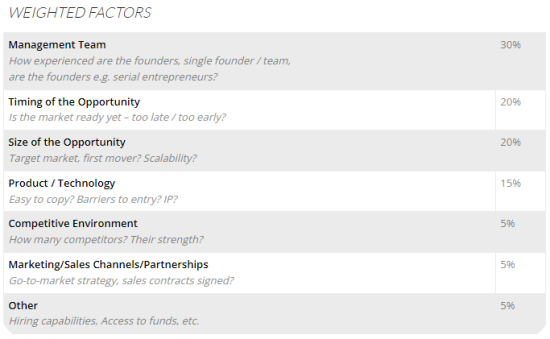

Next, we assign weights to various factors, which can vary depending on the preferences of individual investors. Some may prioritize the quality of the founding team, while others may emphasize the size of the market opportunity. Below, we provide an example with arbitrary weights:

It’s widely recognized that a strong, experienced team of serial entrepreneurs is a key driver of success. In addition, we consider the importance of timing, which has been scientifically proven to be a significant factor in a venture’s success.

Market size and product or technology are also essential considerations, especially for investors who can leverage these factors to facilitate market access and other advantages. Each investor may define additional specific criteria that they find relevant to their investment strategy.

Step 3 - Start the Valuation Calculation

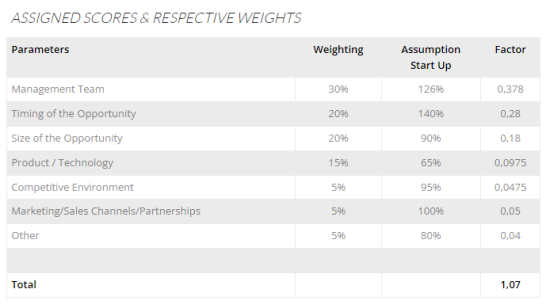

The final step in the Payne Scorecard startup valuation method involves assigning scores to the categories defined in the previous step. The standard baseline assumption is set at 100%. A score of 120% indicates an assessment higher than average, while 80% suggests a lower-than-average assessment. Multiply the assigned scores by their respective weights to calculate the factors.

Adding up all the factors yields the final ratio, which compares our startup’s valuation to the average (benchmark). In this example, the startup being evaluated has a valuation 7% higher than its peers, indicating it is worth 1.37 * 1.07 = 1.47 million euros. This valuation typically aligns with standard venture terms, which significantly mitigate risks for early-stage investors. We recommend considering both valuation and terms together to fully understand the pricing of an offer, as these factors must be balanced carefully.