STARTUP VALUATION

The Berkus Method

In this section, we delve into another widely recognized model for valuing pre-revenue startups: the Berkus Method, named after its creator, Dave Berkus, a prominent Californian angel investor. Though the Berkus Method originated in the 1990s, it has since been refined and adapted to suit contemporary market conditions.

As Dave Berkus states:

The original matrix is too restrictive and should be a suggestion rather

than a rigid form.

Quantitative and qualitative factors

As mentioned earlier, a major challenge with valuing early-stage companies is the absence of substantial revenue figures, and even if a product is available, it’s typically just a minimum viable product (MVP). Most valuation methods depend on revenue and profit projections, but few early-stage startups meet or exceed their initial financial forecasts. As a result, traditional quantitative valuation models may not produce accurate results.

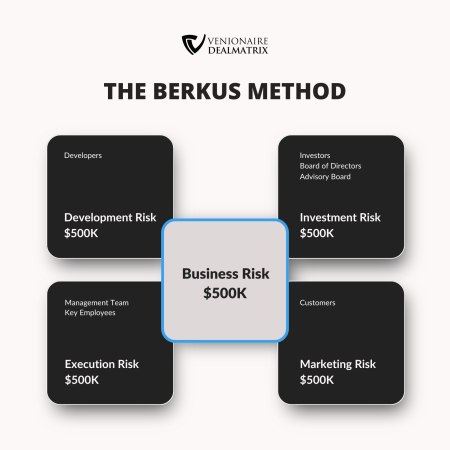

The Berkus Method seeks to address the difficulty of quantifying unquantifiable aspects by employing a blend of qualitative and quantitative factors. It calculates valuation based on five key elements:

1) Valuable business model (base value)

2) Available prototype (reducing technology risks)

3) Abilities of the founding or management team – (reducing implementation risks)

4) Strategic Relationships (reducing market risks)

5) Existing customers or first sales (reducing production risks)

Valuation along the key parameters

In the initial step, each of the elements mentioned above must be assigned a monetary value, with a maximum value of EUR 500,000 per element. This allows for a maximum pre-revenue valuation of EUR 2 to 2.5 million. Berkus sets a “soft cap” of EUR 20 million valuation in the fifth year of business, offering investors the potential for a ten-fold return over the life of the investment.

By adjusting the parameters and modifying the maximum added values, you can observe changes in pre- and post-money valuations. Generally, if everything goes well for the startup and investor, the company will achieve stable sales, and the Berkus Method can be replaced by more quantitative valuation methods in subsequent fundraising rounds.