STARTUP VALUATION

The VC Method

The VC method is commonly used to value early-stage, pre-revenue companies, which is why it's a popular valuation approach among venture capitalists worldwide. How does the venture capital method assess a business? The concept is straightforward: VCs and other investors achieve returns when a liquidity event (an exit) takes place, and they anticipate a specific rate of return on their investments.

This can be expressed as:

Expected Return on Investment (RoI) = Exit Value / Post-money Valuation

which means

Post-money Valuation = Exit Value / Expected Return on Investment (RoI)

Exit Value

The Exit Value (EV), also known as Terminal Value, is the estimated value the company will be sold for in the future. In the Venture Capital method, this is typically calculated as a multiple of the company’s revenues in the year of sale. Since this method is often applied to early-stage, pre-revenue startups with negative cash flows, EBIT multiples usually aren’t applicable.

For public companies, finding the appropriate multiple is straightforward, as their revenue and market cap information is freely available. However, for private companies, particularly startups, this can be more challenging. Data points are primarily generated during events like fundraising or exits and are often not made public. Therefore, a combination of public company data and PE/VC databases serves as a useful starting point for estimating an exit multiple. Here’s an example scenario for a company that:

– is expected to generate €15 million in revenues at the year of sale

– assuming a sales multiple of 2

the anticipated Exit Value is €30 million.

Rate of Investment

The Rate of Investment (RoI), or Rate of Return, is often expressed as a multiple of the initial investment. The RoI is determined by the level of risk perceived by investors. Since startups are inherently risky and many do not reach profitability, the few that succeed must generate returns sufficient to compensate for the rest, ensuring the entire portfolio delivers adequate returns. Moreover, unlike traditional investors in public companies, venture capitalists typically hold 5 to 10 companies in their portfolio and are not fully diversified. Therefore, the target RoI for early-stage companies is quite high, often aiming for a return of 10x.

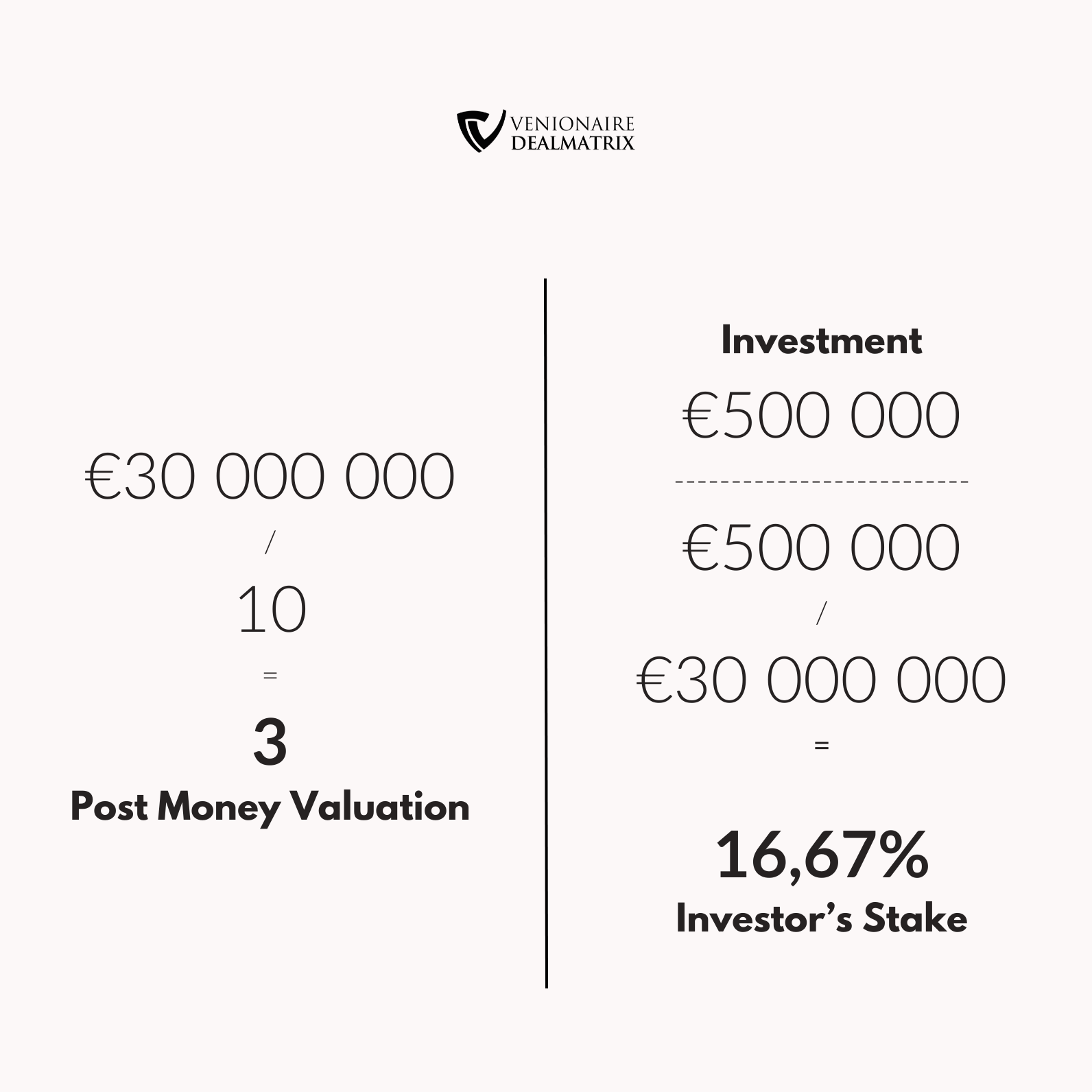

Returning to our example:

Exit Value of €30 million / exptected RoI of 10

=

€3 million

Post-money Valuation

In the case of a €500,000 investment, the Pre-money Valuation comes out to be €2,5 million. The investor’s stake would be:

€500,000 / €3 million

=

16,67%

Further Remarks

This calculation does not account for future dilution. Typically, an investor in earlier rounds will face dilution before an exit occurs due to the company issuing new stock in later rounds. There are various methods to adjust for this impact, but to maintain the simplicity that is a hallmark of the VC method, we can simply decrease the pre-money valuation by the expected dilution in future rounds.

In our example, if an investor anticipates

- a 30% reduction in their stake by the time of exit,

- the pre-money valuation would drop to €1.75 million.

- Consequently, the investor’s stake increases to €500,000 / €2.25 million, or 22.2%.

While the Venture Capital method is not a comprehensive model for valuing early-stage companies, its simplicity and directness make it a popular starting point and a useful rule of thumb for more detailed valuation models.