STARTUP VALUATION

The First Chicago Method

The First Chicago Method is a tailored business valuation approach utilized by venture capital and private equity investors for assessing early-stage companies.

The First Chicago method was initially created by the venture capital arm of the First Chicago bank, which later evolved into private equity firms Madison Dearborn Partners and GTCR. It was first introduced in academic discussions in 1987.

This model integrates aspects of market-oriented and fundamental analytical methods, primarily serving to value dynamic growth companies. Let's break down this method step by step.

Step 1: Outline various future scenarios for the company

Typically, you would create three scenarios for an enterprise:

- Best-case

- Mid-case

- Worst-case

To begin, you must develop a financial forecast for each scenario, including revenues, earnings, cash flows, and the exit horizon. A thorough qualitative analysis of market trends and the company is essential to estimate these scenarios accurately. Generally, the mid-case scenario reflects an analyst’s expectations following due diligence.

In many businesses driven primarily by scalability (such as markets with a “winner takes all” dynamic), it makes sense to equate the worst-case scenario with a complete loss of invested capital. Conversely, some businesses operate within markets that impose a natural upper limit on financial outcomes.

However, mastering step 1 requires extensive analytical research and a deep understanding of the circumstances. You may also have the flexibility to account for potential strategic shifts in your financial forecast based on the assumptions of each scenario.

Step 2: Calculate the divestment price for each scenario using multiples

Once your financial forecast is established, you need to calculate the Terminal Value (TV) at the time of exit (divestment price). This is where we use a market-oriented valuation approach involving multiples. The concept is to estimate valuation by comparing the investment to other transactions within the same peer group.

In the venture industry, peer groups are typically defined by:

- Enterprise industry

- Enterprise stage

- Enterprise region

There are several types of multiples, each suitable for different asset classes. In the venture industry, professionals use multiples based on KPIs such as EBIT and revenues. A key element of this market-oriented approach is the transaction data of the peer group. Although data on M&A activity in the venture industry may be scarce, there are specialized data providers that focus on this sector.

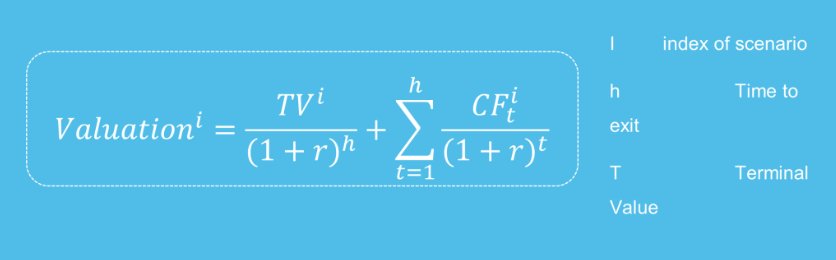

Step 3: Calculate the required return and establish the valuation for each scenario

Many venture capitalists determine their required return internally. They often avoid relying on concepts like WACC (Weighted Average Cost of Capital) and CAPM (Capital Asset Pricing Model) because the private equity market is incomplete, and it’s not possible to replicate an investment’s payoff with a portfolio of assets. However, we will provide a brief introduction to the WACC concept, which can be adjusted for the venture market.

Additionally, we will assume no debt capital in the financial forecasts, which simplifies the WACC to just the cost of equity (a reasonable assumption when valuing early-stage companies).

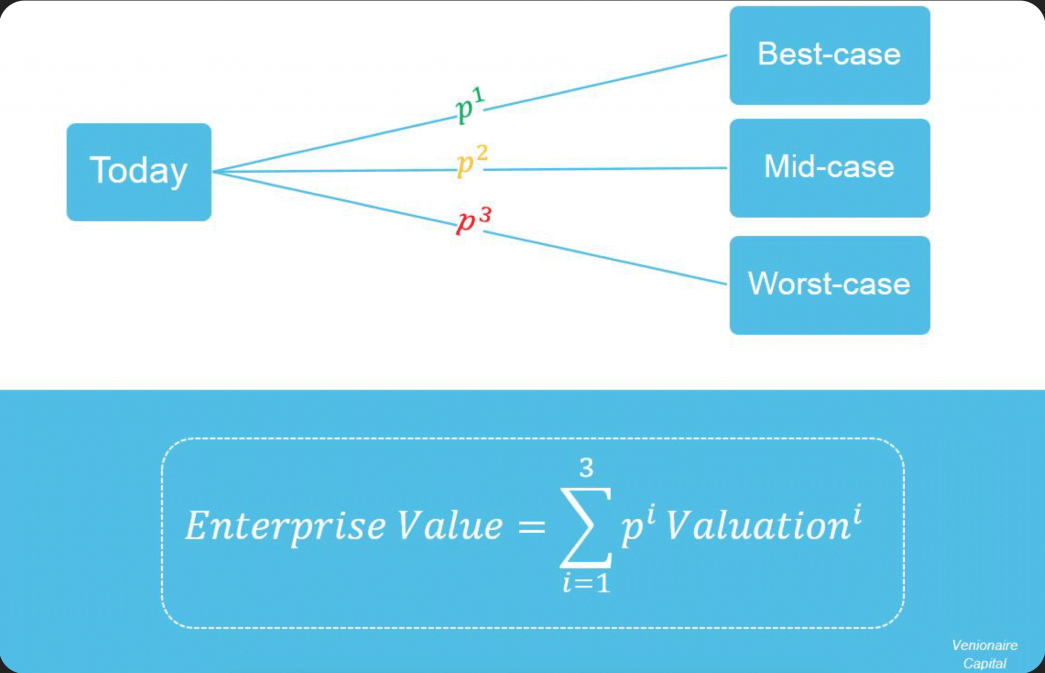

Step 4: Assess the probabilities of each scenario and calculate the weighted sum

For the final step, assign a probability to each scenario. These probabilities are naturally linked to your scenario definitions and their quantity. It’s important to incorporate extreme outcomes into your valuation process, even though precise probabilities for each scenario may be difficult to estimate.

Calculate the weighted sum of the valuations based on the probabilities of each scenario to arrive at your final valuation.

The First Chicago Method is a comprehensive approach that allows you to account for low-probability, high-impact events that could significantly affect your investment payoff. This flexibility adds complexity to your valuation framework, but at Venionaire Capital, we embrace this additional effort. We specialize in conducting thorough analyses of tech-related young companies and scrutinize each one until we achieve a clear understanding of all possibilities.

In Step 2, we utilize data flows from our partner networks and professional data providers. The selection of the multiple is influenced by the peer group and the enterprise structure. Our extensive experience in this field has enabled us to develop an advanced framework for categorizing startups.

In Step 3, we conduct a market analysis that includes both short-term assessments of the business case’s potential and long-term evaluations to identify fundamental market trends. Our analysis considers all aspects of the enterprise and their impact within the specific company-peer group context.