STARTUP VALUATION

The Venionaire Method

Most startup valuation models are tailored for either pre-revenue, early-stage, or later-stage companies, typically focusing solely on either financial or qualitative methods. How should we address the differences in team quality and business cases among similar companies? Relying solely on numbers won't provide a comprehensive view. While many plans project hockey stick growth in 2 to 5 years, the real trajectory often takes longer and requires more funding.

We must consider the unique strengths and weaknesses of each company, including their team, market, product, technology, and scaling strategy. Recognizing the limitations of existing startup valuation models, we developed the Venionaire Startup Rating Method.

Advantages of the Venionaire Method

Existing models such as the First Chicago Method, Venture Capital Method, Scorecard Method, and Berkus Method make it challenging to compare companies because they don’t account for individual strengths and weaknesses. Different stages of development require different methods, often resulting in significant variations in outcomes. Investment analysts, managers, and business angels use the results of these models as a foundation for making decisions. Premiums paid or discounts received relative to the average valuation are largely influenced by intuition and negotiation skills.

At Venionaire, we like to say, “Valuation is an art based on experience.” With this in mind, we have developed a proprietary model for investors that can be used across different stages. It goes beyond pure qualitative or financial approaches, adjusting the average valuation you’ve calculated or observed from the market and revealing how much you may overpay or underpay. By reducing reliance on gut feeling and increasing transparency, the Rating Method valuation helps you achieve a fair deal.

How it's done

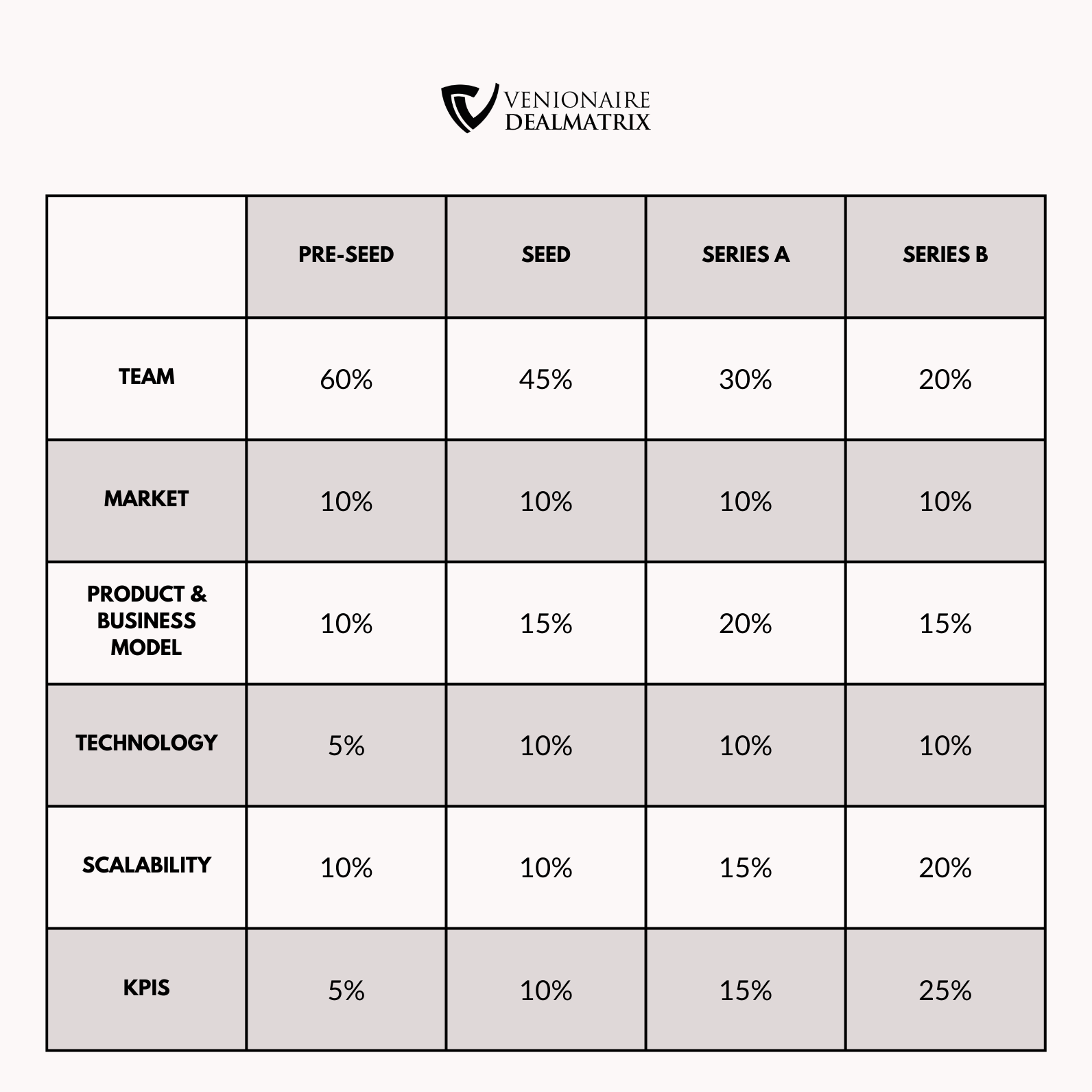

Our model is based on a straightforward scorecard approach, incorporating essential elements that enhance its ability to align with your investment strategy. We have identified six key drivers: Team, Market, Product & Business Model, Technology, Scalability, and KPIs. These are the factors we consistently assess when evaluating a potential deal.

Evaluate each of the factors below for your specific company by assigning a score from 1 to 5 and noting the reasoning behind your chosen score. This approach helps maintain a high standard of quality and transparency within our team. It also clarifies the assumptions and implications of your assessment. Certain factors hold more significance in the early stages of development, while others gain importance in later stages. Therefore, we have developed a weighted matrix for these value drivers (see Table 1).

Startup Rating

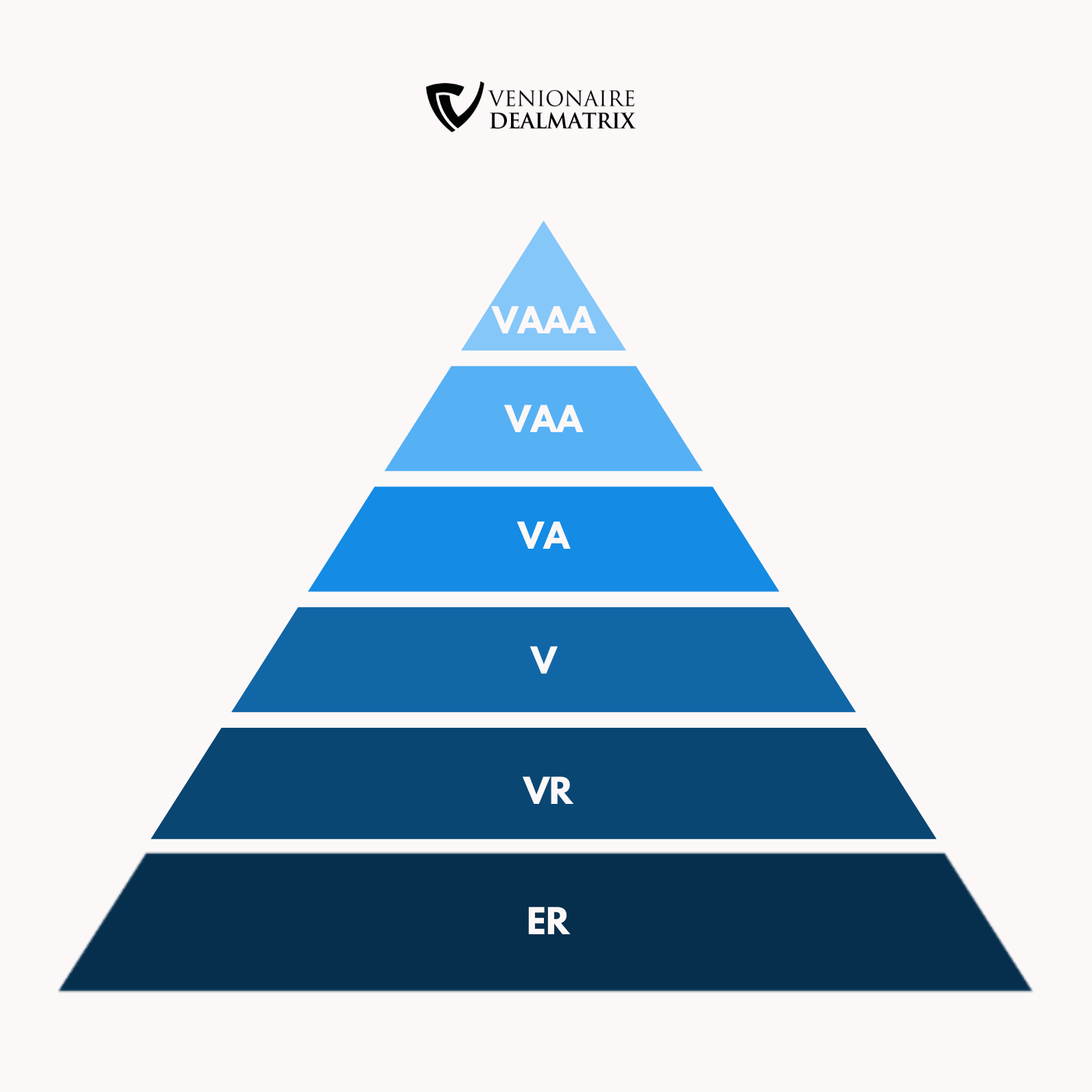

By multiplying each score with its corresponding stage-relevant weight and summing all the factors, we arrive at a number that translates into a rating:

VAAA: Very Strong company (Top 5%) within a particular industry, stage, and region.

VAA: Strong company (Top 10%) within a specific industry, stage, and region.

VA: Above Average, scoring above 3.5.

V: Average, aligning with comparable startups.

VR: Very Risky, where key value drivers are considered weak.

ER: Extremely Risky, where it is advisable for investors not to invest.

Finally, multiply the rating of each value driver with the average valuation while considering a premium or discount factor for each value driver. This adjustment allows you to calculate an entity value for your company.