Valuing private companies has always been harder than it should be.

Across Venture Capital, Private Equity, and M&A, professionals are asked to make pricing decisions in environments where transparency is limited, comparables are scarce, and context matters deeply. Yet despite this complexity, the tools used to anchor valuation discussions have changed surprisingly little.

In practice, most private-market valuations still rely on a mix of experience, precedent transactions, and public-market valuation multiples. Not because these tools are ideal, but because there has been no widely available alternative designed specifically for private markets.

This structural gap is what led to the development of Venionaire DealMatrix Multiples.

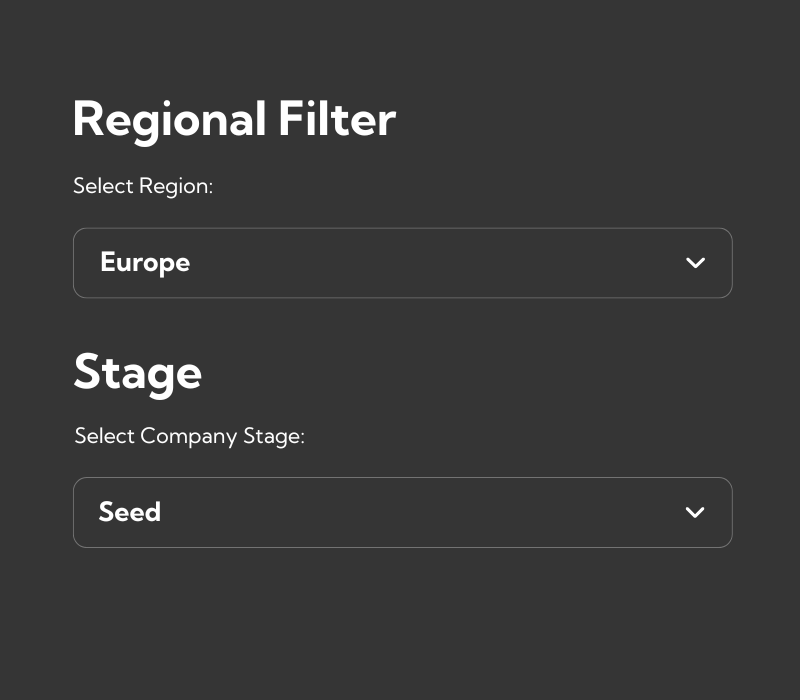

Figure 1: Venionaire DealMatrix Multiples

The structural problem in private market valuation

At its core, valuation with multiples is about comparability. Investors, startups and advisors want to understand whether a price makes sense relative to the market. In public markets, this comparison is straightforward. Transactions are transparent, companies are continuously priced, and valuation multiples are readily observable.

Private markets operate differently. Private transactions are rarely public. Deal terms are negotiated bilaterally. Companies differ widely in maturity, capital structure, governance, and growth profiles. Even within the same sector, pricing can vary significantly depending on stage, geography, and market conditions.

As a result, private markets lack a shared valuation reference layer.

Why public-market multiples became the default

In the absence of a dedicated private-market framework, public-market valuation multiples became the default reference. Datasets such as sector multiples from public comparables are transparent, structured, and easily accessible. They provide a starting point when no better benchmark exists.

However, public-market multiples reflect a fundamentally different environment. They are shaped by liquidity, scale, standardized reporting, stable governance, and immediate exitability. These characteristics rarely apply to private companies, even at later stages. Using public multiples in private deals therefore requires interpretation and adjustment. While this can work in individual cases, it introduces inconsistency and subjectivity at scale.

The numbers appear precise, but the underlying assumptions often do not hold.

Fragmentation instead of structure

Private markets are not short on data or expertise. Transaction experience, sector knowledge, and proprietary datasets exist across funds, advisors, and institutions.

What has been missing is structure.

Valuation benchmarks are rarely contextualized in a consistent way across sectors, company stages, and regions. As a result, pricing discussions often depend heavily on individual experience and narrative rather than a shared reference.

This makes it difficult to compare opportunities, align internal decision-making, or communicate valuation logic across teams and stakeholders.

Building a private-market methodology from the ground up

Venionaire DealMatrix Multiples were developed to address this exact gap.

Instead of adapting public-market benchmarks, the focus was on building a methodology explicitly designed for private companies. The objective was not to replace judgment or detailed analysis, but to provide a consistent reference layer that reflects private-market realities.

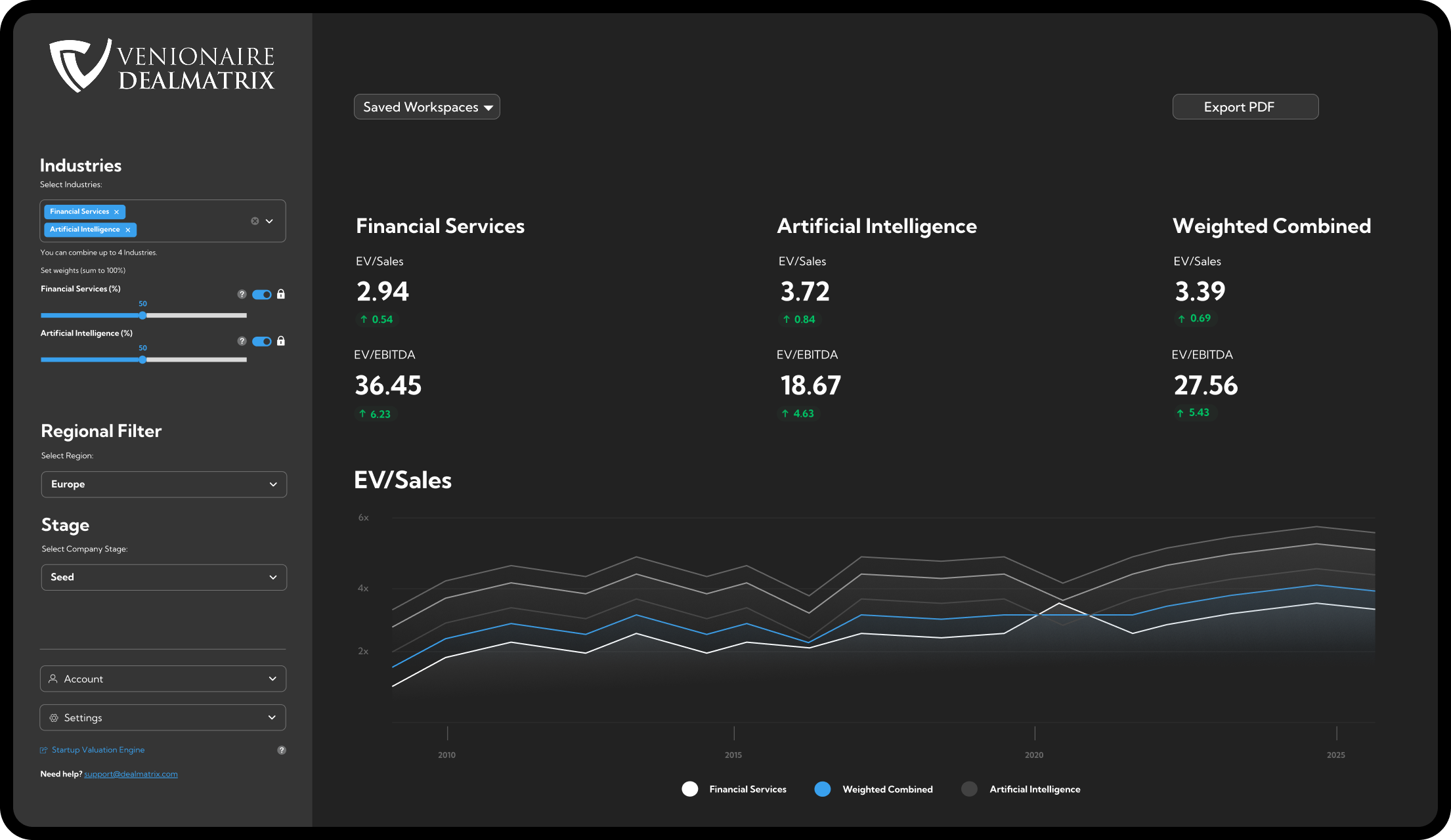

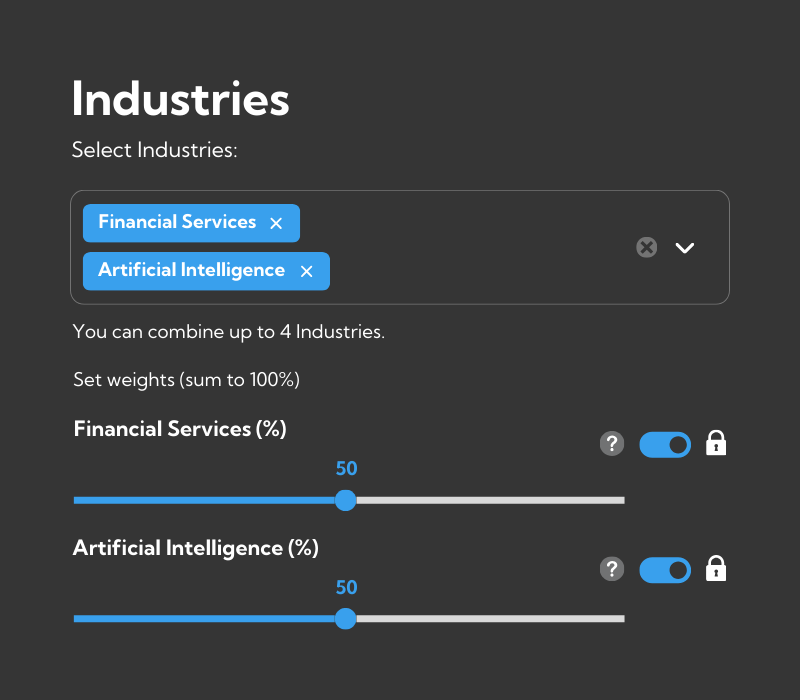

The result is a framework for calculating EV/Sales and EV/EBITDA valuation multiples for private companies, structured by:

industry (140+)

company stage (from Pre-Seed to Series E)

geographic region

Public market data serves as a foundation for peer-group identification, but is systematically contextualized using macroeconomic indicators and proprietary private-market data accumulated through long-standing activity in Private Equity, Venture Capital, and M&A. The outcome is a curated and contextualized multiple dataset designed specifically for private markets.

Introducing Venionaire DealMatrix Multiples

Today, “Venionaire DealMatrix Multiples” is officially live.

The product provides private-market EV/Sales and EV/EBITDA valuation multiples that can be explored by sector, stage, and region.

Figure 2: Industries Filter

Figure 3: Regional & Stage Filter

This is offering a clearer reference for valuation discussions, deal screening, and comparative analysis. It is designed to support professionals who need to make pricing decisions in environments where transparency is limited and comparability is hard to establish.

To introduce the product, the DealMatrix team has prepared a short video showcasing how Venionaire DealMatrix works and how private-market valuation multiples can be explored in practice.

A note on scope

Venionaire DealMatrix Multiples are not intended to replace detailed financial models or investment judgment. Their role is to reduce reliance on public-market proxies that were never designed for private markets and to provide structure where none previously existed.

In that sense, the launch of Venionaire DealMatrix Multiples represents a step toward more consistent, comparable, and context-aware valuation practices in private markets.