INVITE FRIENDS AND GET VALUATION REPORTS FOR FREE

and other new features of DealMatrix Valuation Engine

DealMatrix is a SaaS platform that offers an easy way to evaluate early-stage startups by applying sophisticated venture valuation methods. It aims to reduce time and effort to pre-select startup opportunities for business angels and venture funds.

Startups can easily create a snapshot of their business, with all necessary high-level information incl. a valuation and the underlying assumptions. Our aim is to make the startup investment transaction process faster and more transparent. The software automatically generates reports based on the input data that can be used by investors, startups, and advisors supporting them, and effectively address investors through its investor directory.

By using DealMatrix, users can quickly and easily value startup projects and generate reports that they can share with one another, as well as their business partners and (co-)investors.

In this article, we will introduce you to each step of using the DealMatrix software:

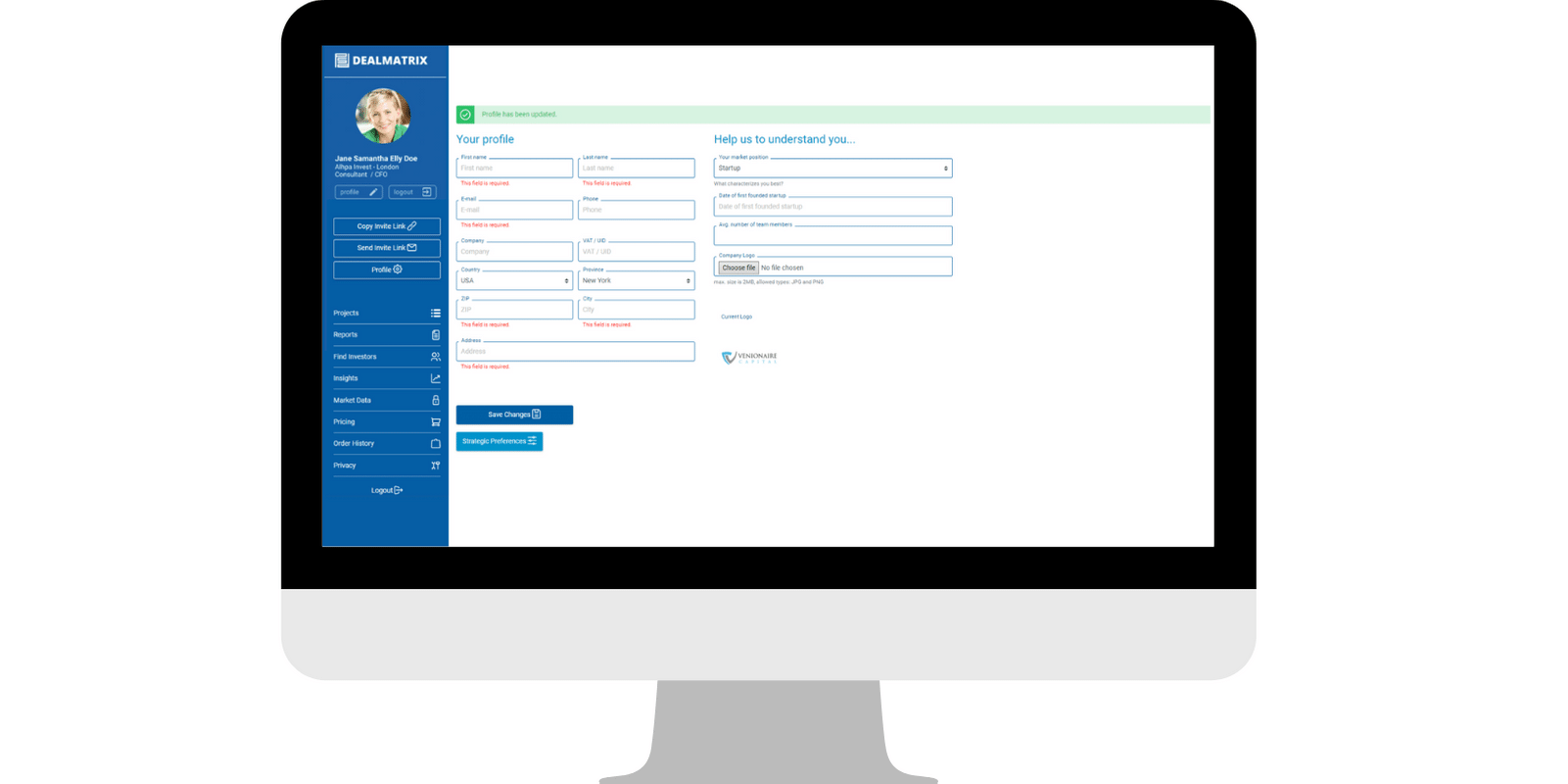

Step 1: Create a Profile

All you need is your LinkedIn account to log in and create your free account on DealMatrix Engine. DealMatrix will create a user, as you log in with your LinkedIn profile, instead of asking you to set up a new user and password.

Complete Your Profile and get your first 3 credits (FREE)

In order to benefit from all DealMatrix features at the later steps of project valuations, you should complete your profile before proceeding with the project evaluation. For doing so, the system rewards you with an airdrop of 3 credits. Each credit can be used to generate a report.

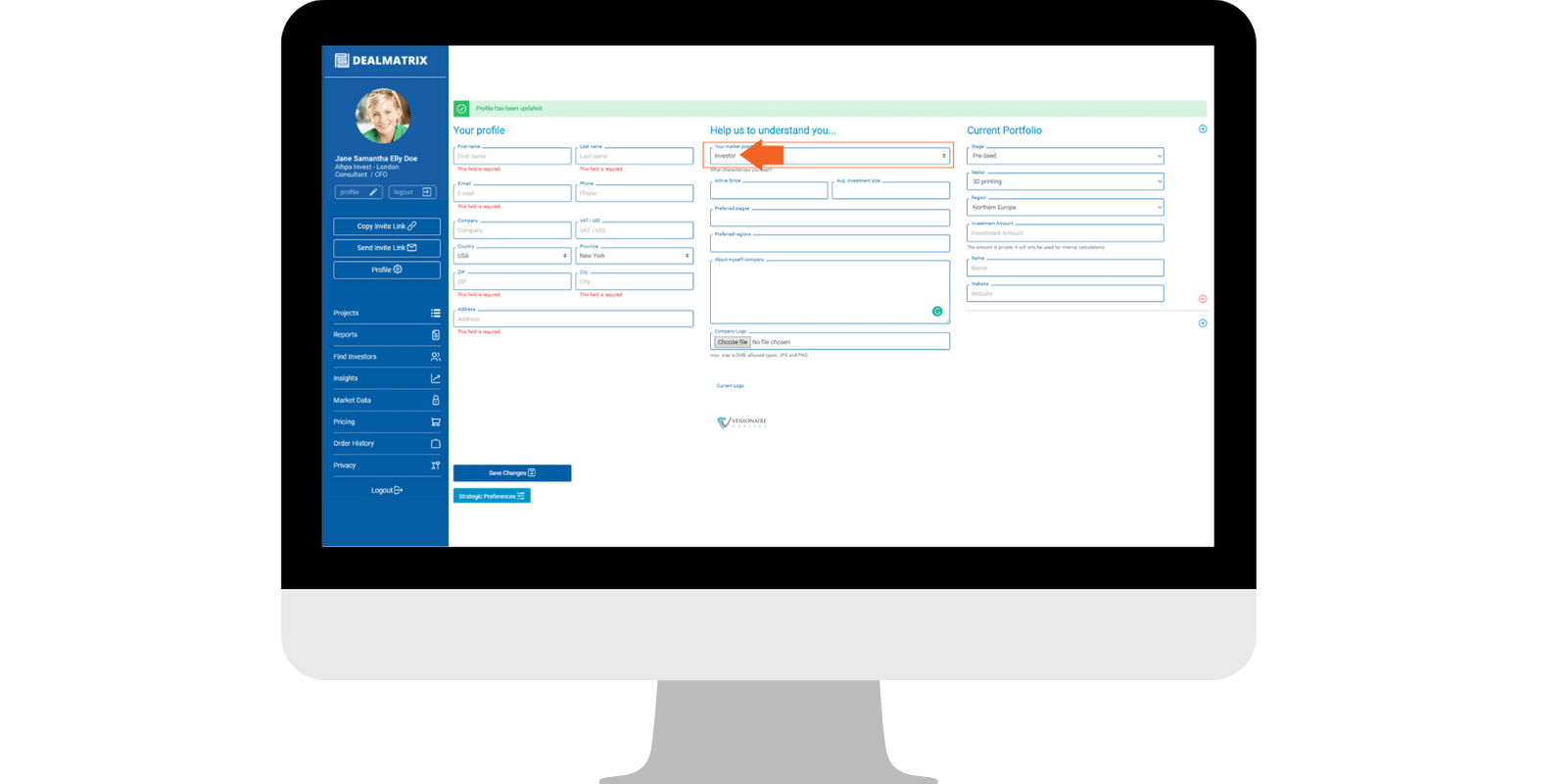

- ‘’Your Profile’’ section requires you to fill in basic contact information, this information will be later displayed on your profile and valuation reports.

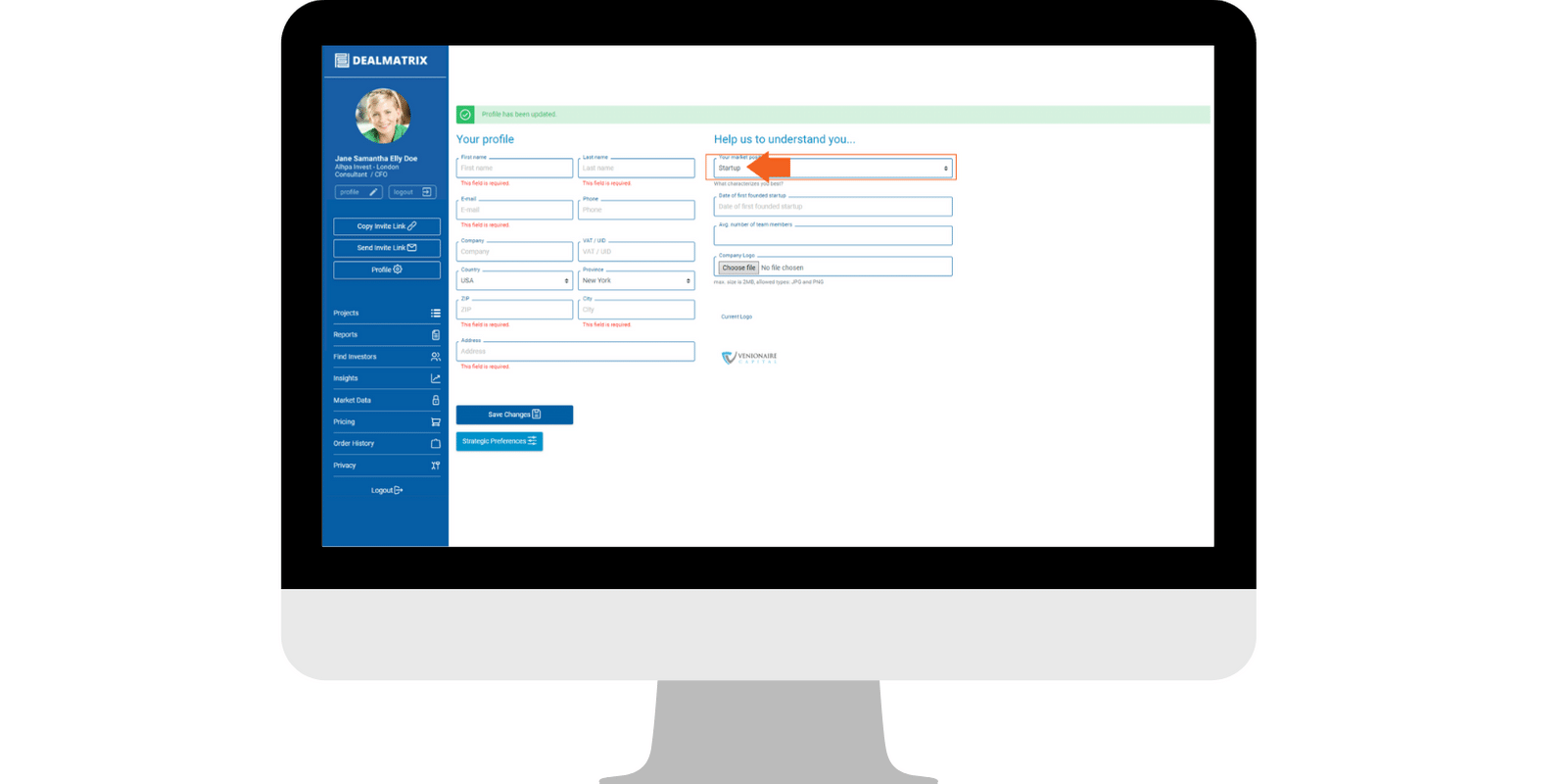

- ‘’Help us to understand you…’’ section requires you to fill in information based on your user category as a Startup, Investor or Consultant.

Note: Dealmatrix differentiates between Startup, Investor and Advisor (Consultant) profiles.

- Startup profiles are the quickest ones to set up. Startups are required to only fill in their founding date, the average number of their team members (within the last 6 months) and to upload a company logo (optional).

- Investor profiles require a bit more “color” since it will help with receiving dealflow suggestions that are truly interesting to them. For this reason, investors are asked to fill in

- the year since which they are active as investors

- their average investment size

- preferred regions

- a short description about themselves (and their strategy)

- a brief outline of their current portfolio. The information which was filled in the account will also help to generate an individual activity rating for the investor directory.

- Advisor (Consultant) profiles are similar to Investor profiles, however, instead of filling their current portfolio, they are asked to explain their field of expertise instead. Advisors are not limited to the fields of expertise list that they want to be displayed in their profiles (we recommend stating no more than 5 fields of expertise).

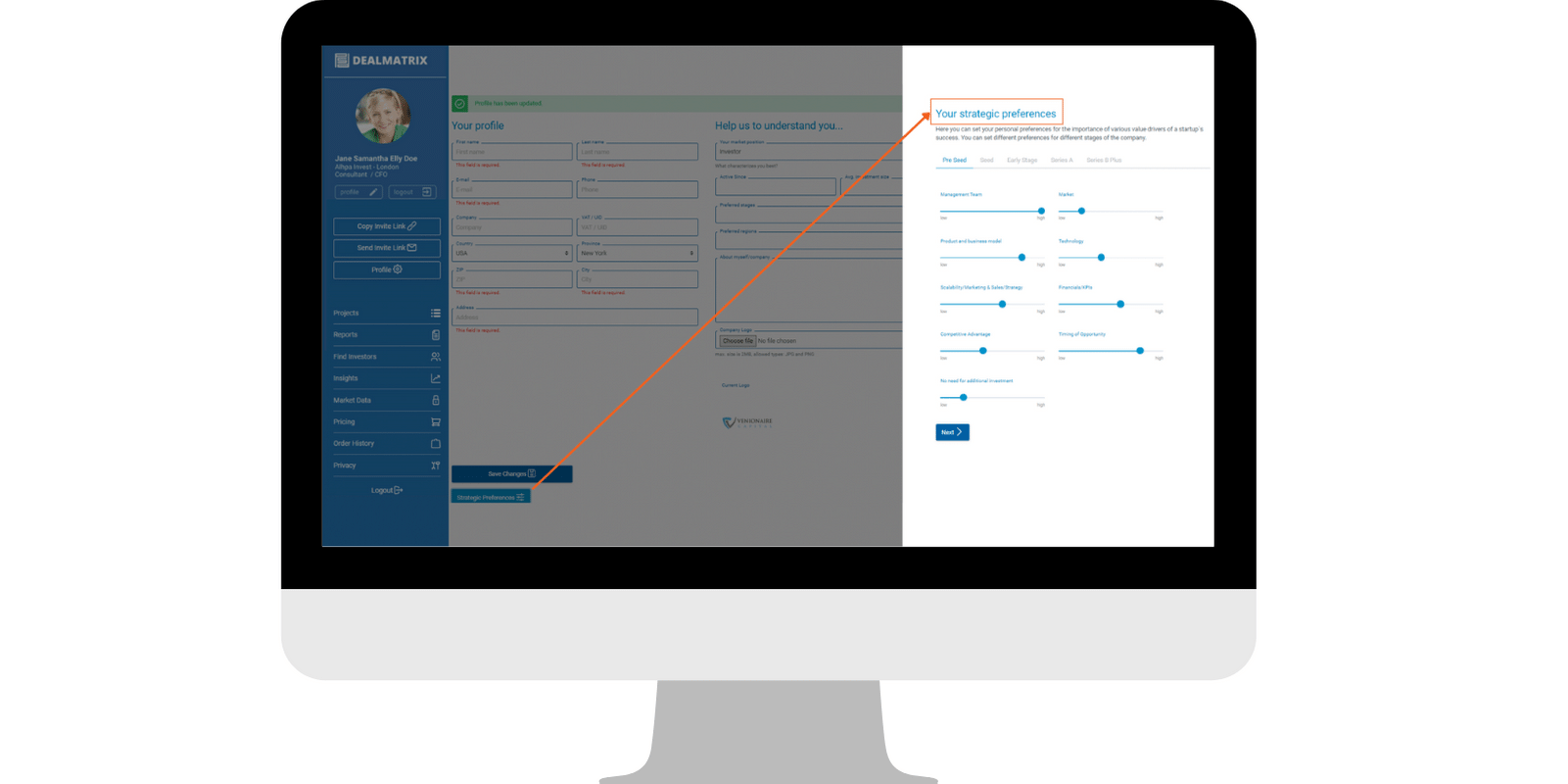

Set up Your Strategic Preferences

At the bottom left corner of the profile page, there is a button ‘’Strategic preferences’’. By clicking it, you will open a new window (on the right side of the screen) that will allow you to set your personal preferences by choosing the importance of certain aspects at different startup stages.

For example, one investor believes that the team is more important for seed-stage startups, rather than for a Series A startup. However, this preference may differ among other investors which impacts valuation results due to given strengths and weaknesses of startups.

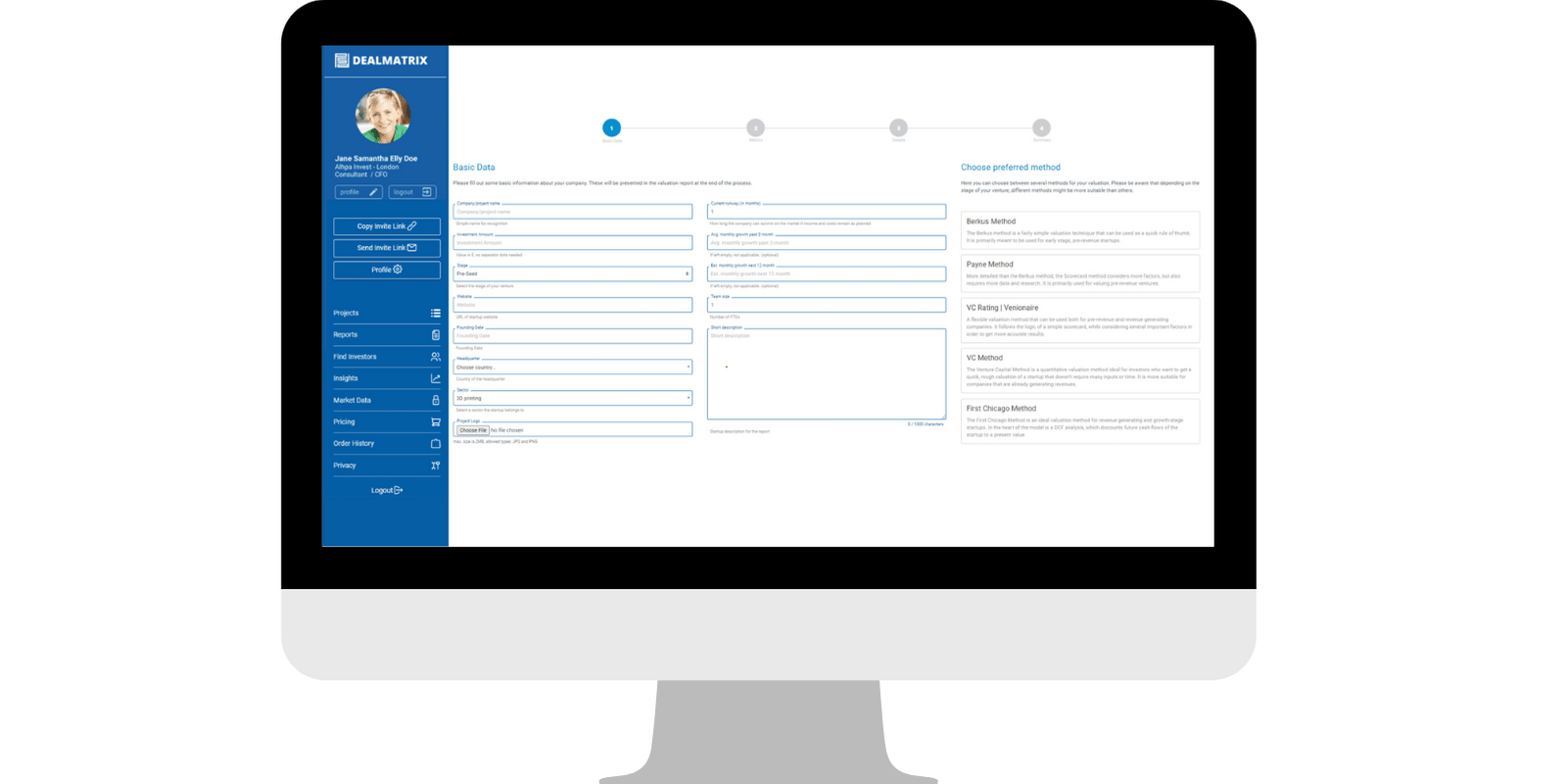

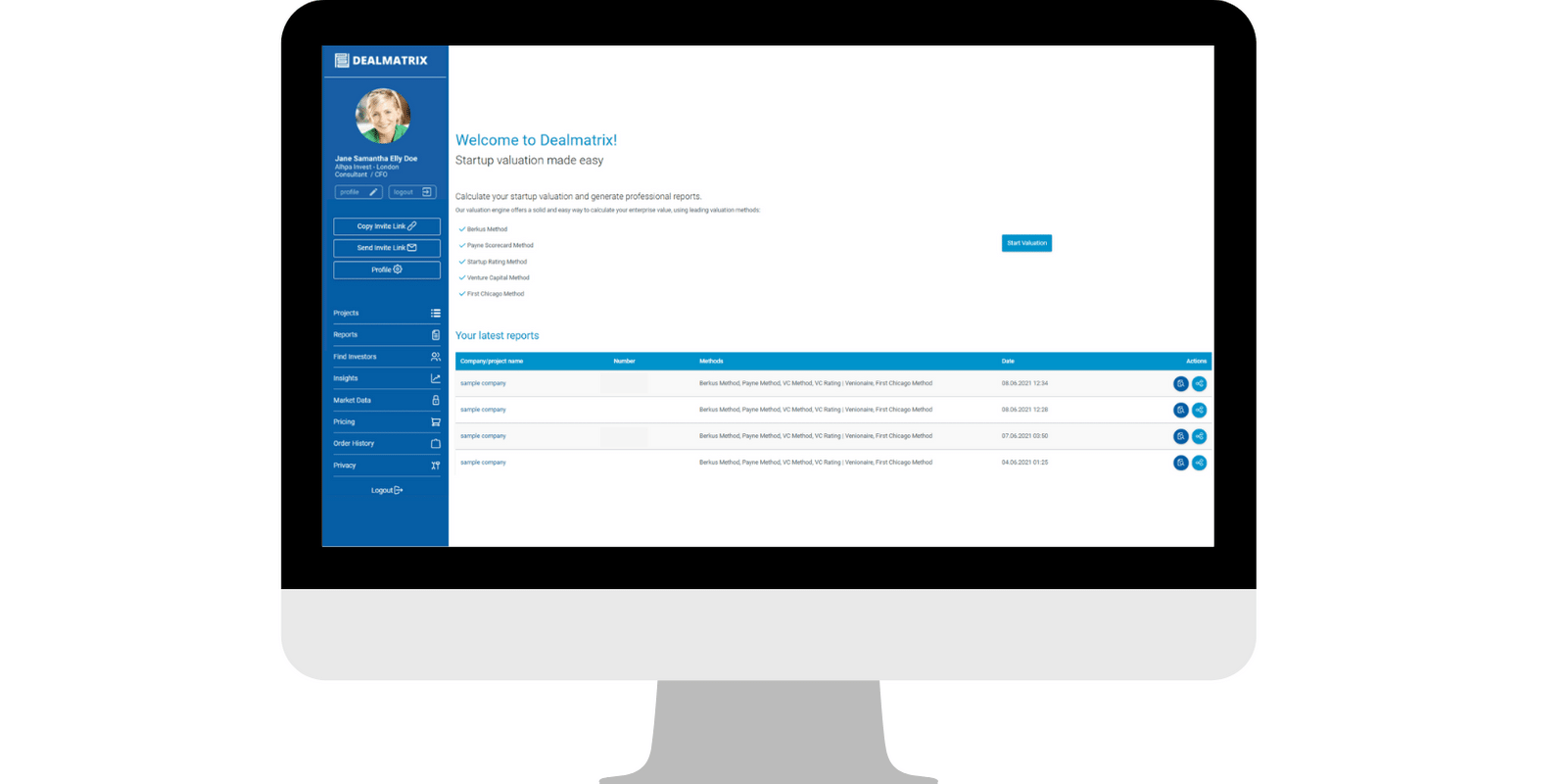

Step 2: Create a Project

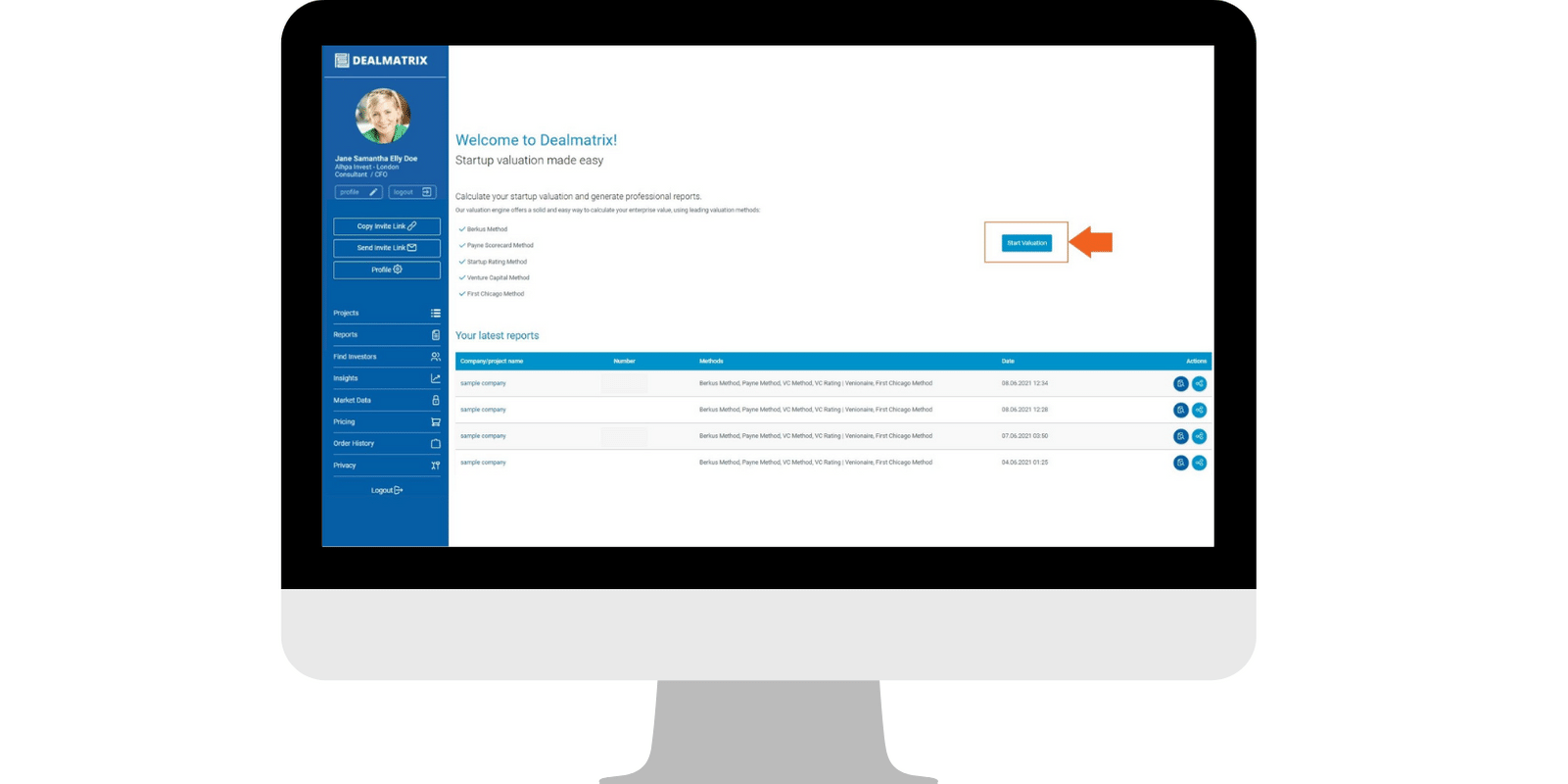

By clicking on the DealMarix logo above your profile picture in the upper left corner or “Projects” in the menu, you will enter the main view of the DealMatrix Engine. On the right side of this page, there is a small button called ‘’Start Valuation’’. After pressing this button, users can start the valuation of a company in a simple four-step questionnaire.

Basic Data and Choice of Valuation Methods

At the first stage, the engine questionnaire requires you to fill in very basic information about the company you are evaluating: name, website and stage, as well as to choose the appropriate valuation methods.

Each valuation method has a brief explanation, so you can choose which methods are more suitable for a particular project you are evaluating. For example,

- the Berkus and Payne Scorecard methods are better suited for early-stage (even pre-revenue or pre-seed / seed stage) companies while

- the Venture Capital (VC) and First Chicago Method are better suited for revenue-generating companies.

DealMatrix also offers a fifth hybrid valuation method developed by the Austrian VC firm – Venionaire Capital, which is suitable for both: pre-revenue and revenue-generating companies.

Choosing different valuation methods will impact the necessary metrics for conducting the valuation. In this tutorial, we chose all methods to provide a better overview of the engine features.

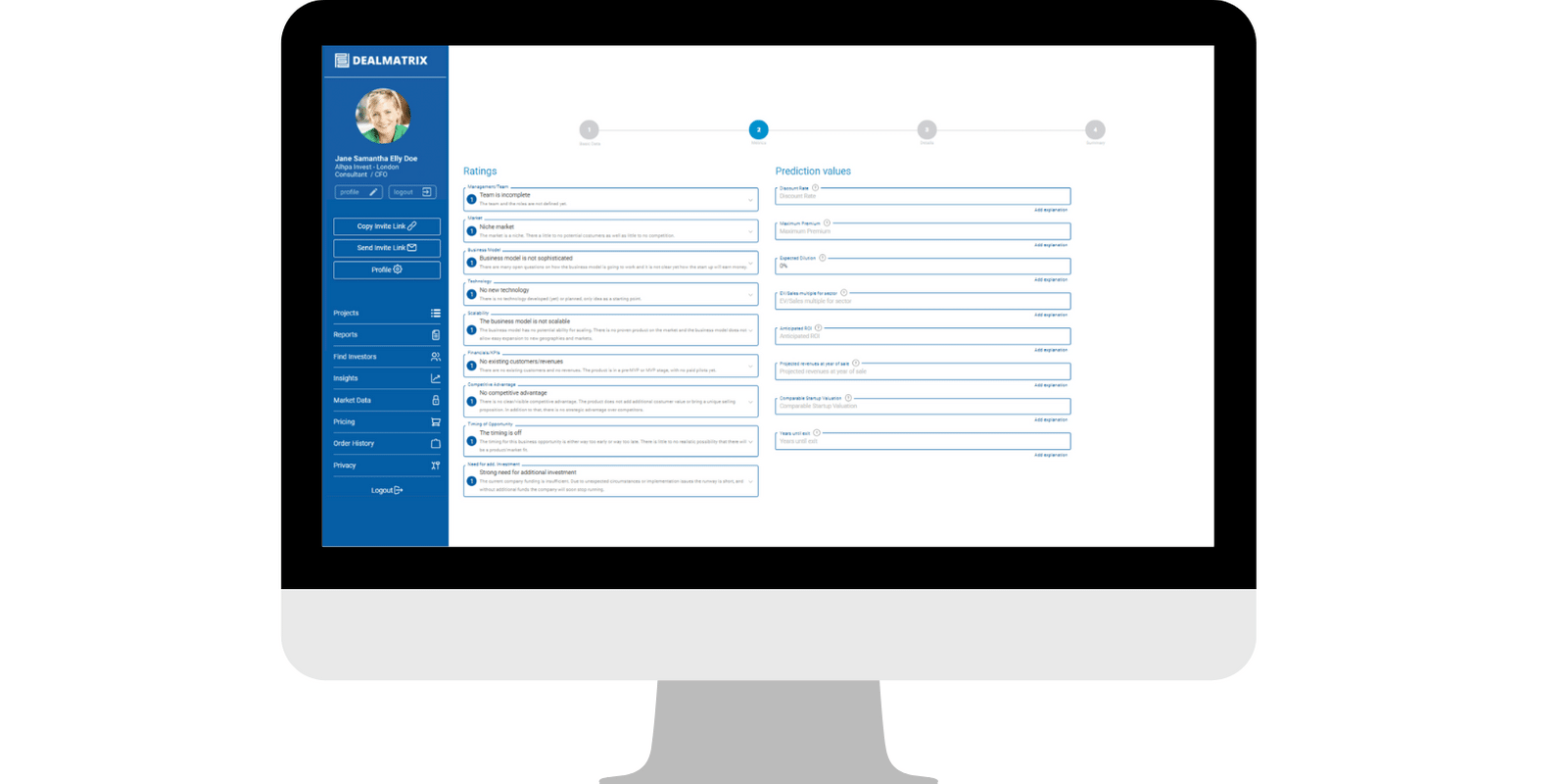

Valuation Metrics

At the next stage, the engine questionnaire runs on two main categories of metrics – ‘’ratings’’ and ‘’prediction values’’. Each category/question has a detailed explanation to support your assumptions/inputs.

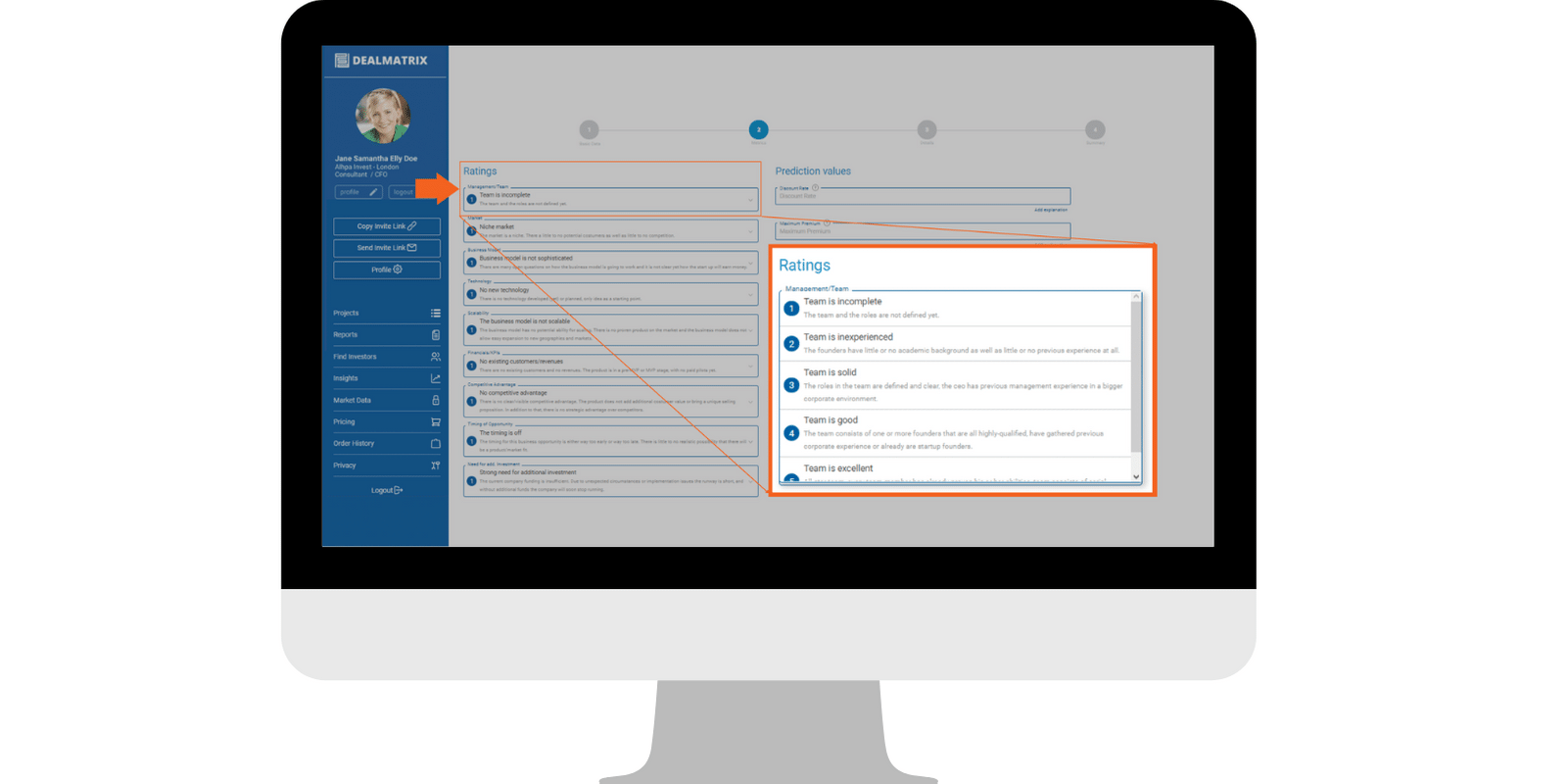

- ‘’Ratings’’ are a qualitative category that allows users to value different startup factors from 1 (best) to 5 (worst). Each rating has a detailed explanation for each point.

Qualitative factors are very important to take into account for early-stage companies and should not be underestimated. Purely number-driven methods would not make too much sense at this stage.

- “Prediction Values” have detailed descriptions that can be accessed by clicking on the small question mark next to each value and its description will come up on the right side of the screen.

Details

The next stage of the engine requires you to fill in information that can further demonstrate the project value outside the constraints of the valuation method. This includes information such as:

- the expected runway,

- the company’s competitors,

- the future use of funds,

- the cap table,

- the latest financials.

Similar to the previous stage, there is a small questionnaire that can provide more details for each step. This information is often missing in pitch-decks, yet extremely important for investors to understand to decide if they are willing to invest more time to explore an opportunity.

Keep in mind that business angels and venture funds receive up to 3.000 deals per year and will only look closer at 1-2 deals per week, which means in return that most deals are rejected after a very high-level review. This makes Dealmatrix snapshots so valuable for investors, as they have every information needed at hand.

Summary

At the last stage, you will see the overview of your inputs and, when made assured that all details are correct, use one credit to generate a downloadable valuation report as a PDF.

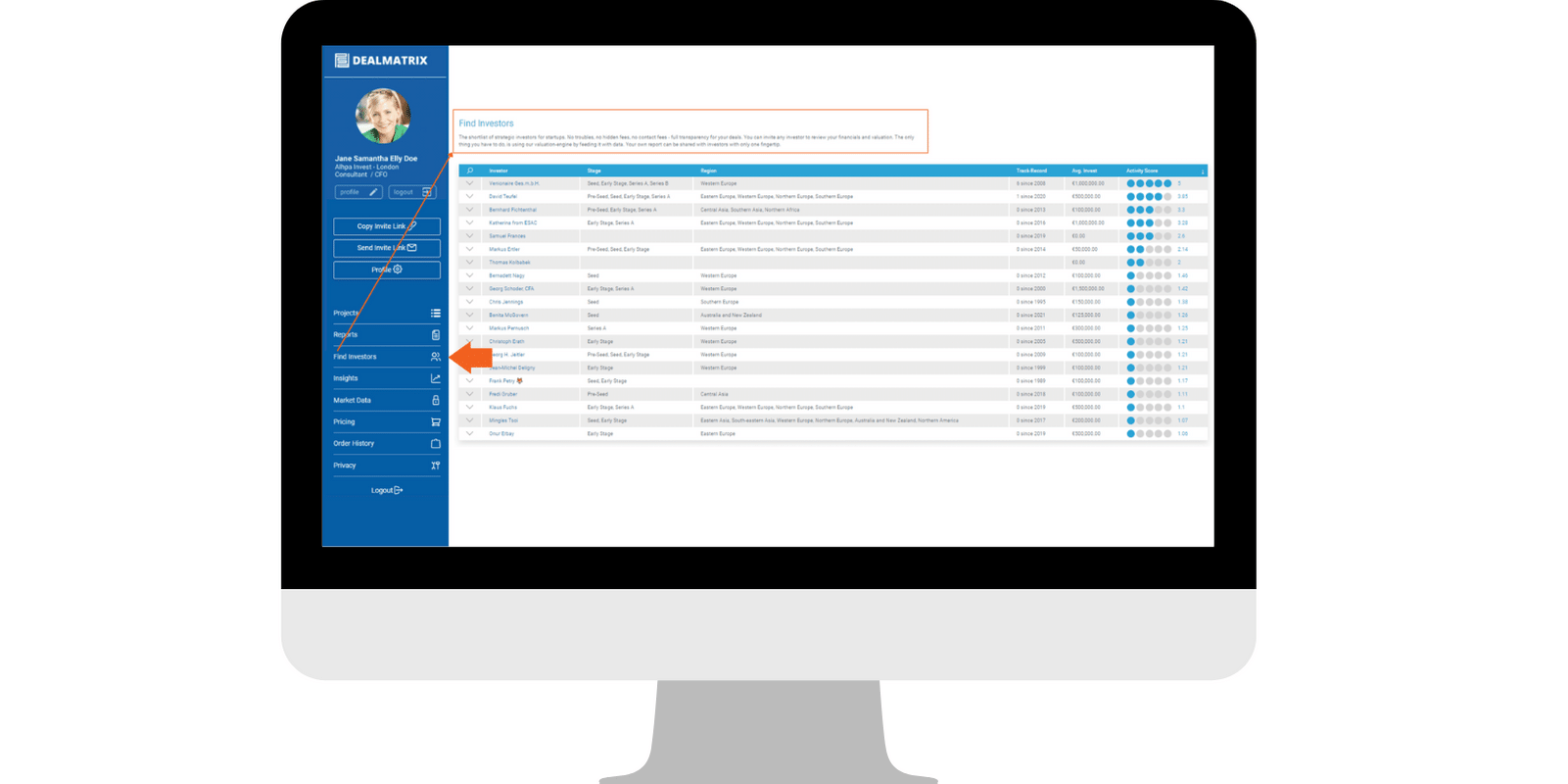

Step 3: Find Investors (Premium Feature)

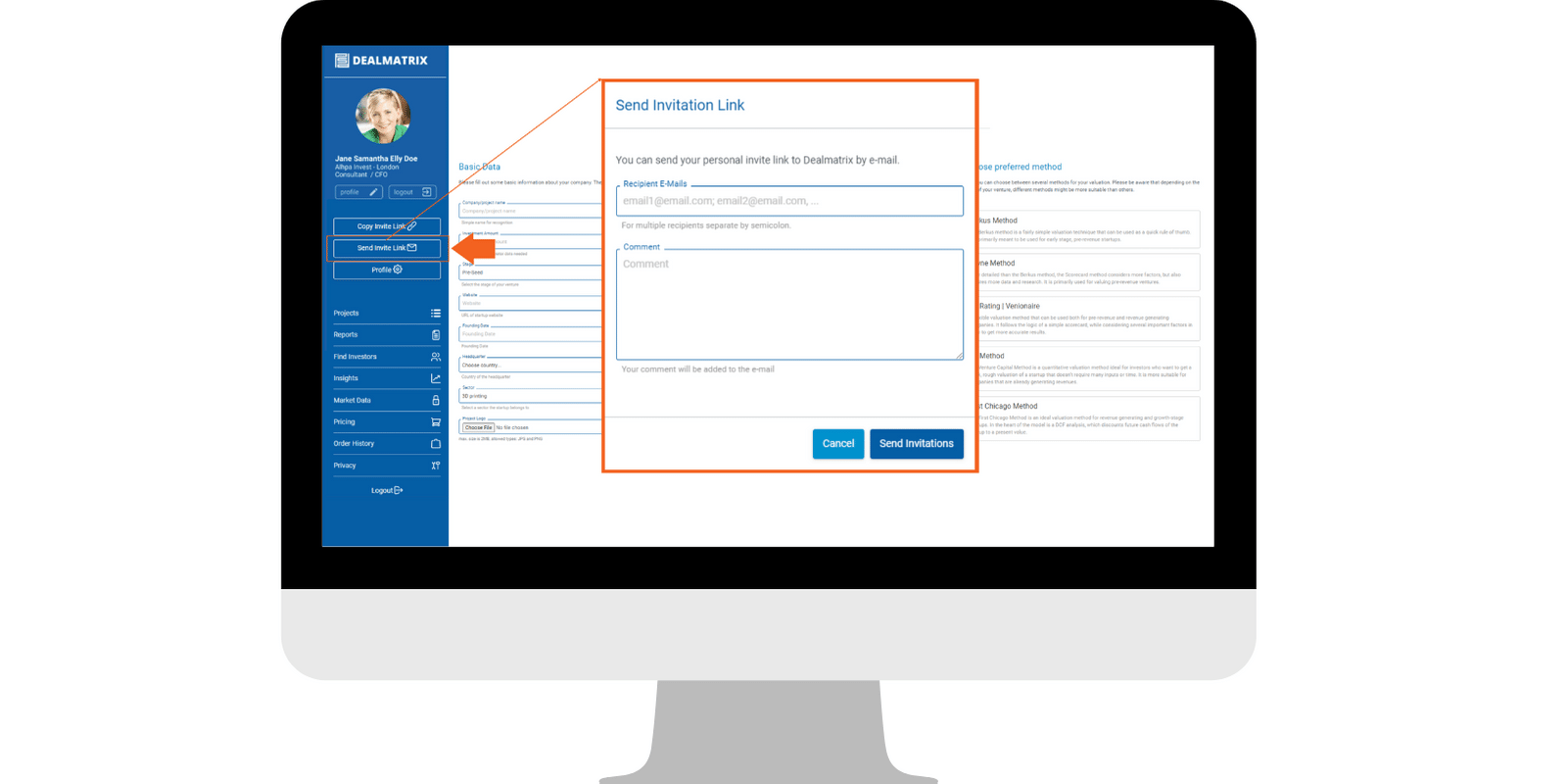

Apart from being able to share the report directly via DealMatrix to email addresses of your business partners / investors, the latest update of Dealmatrix offers users to exchange reports, with new contacts. This feature was added to enable a quicker and more transparent way of screening and matching dealflow with the right (co-)investors.

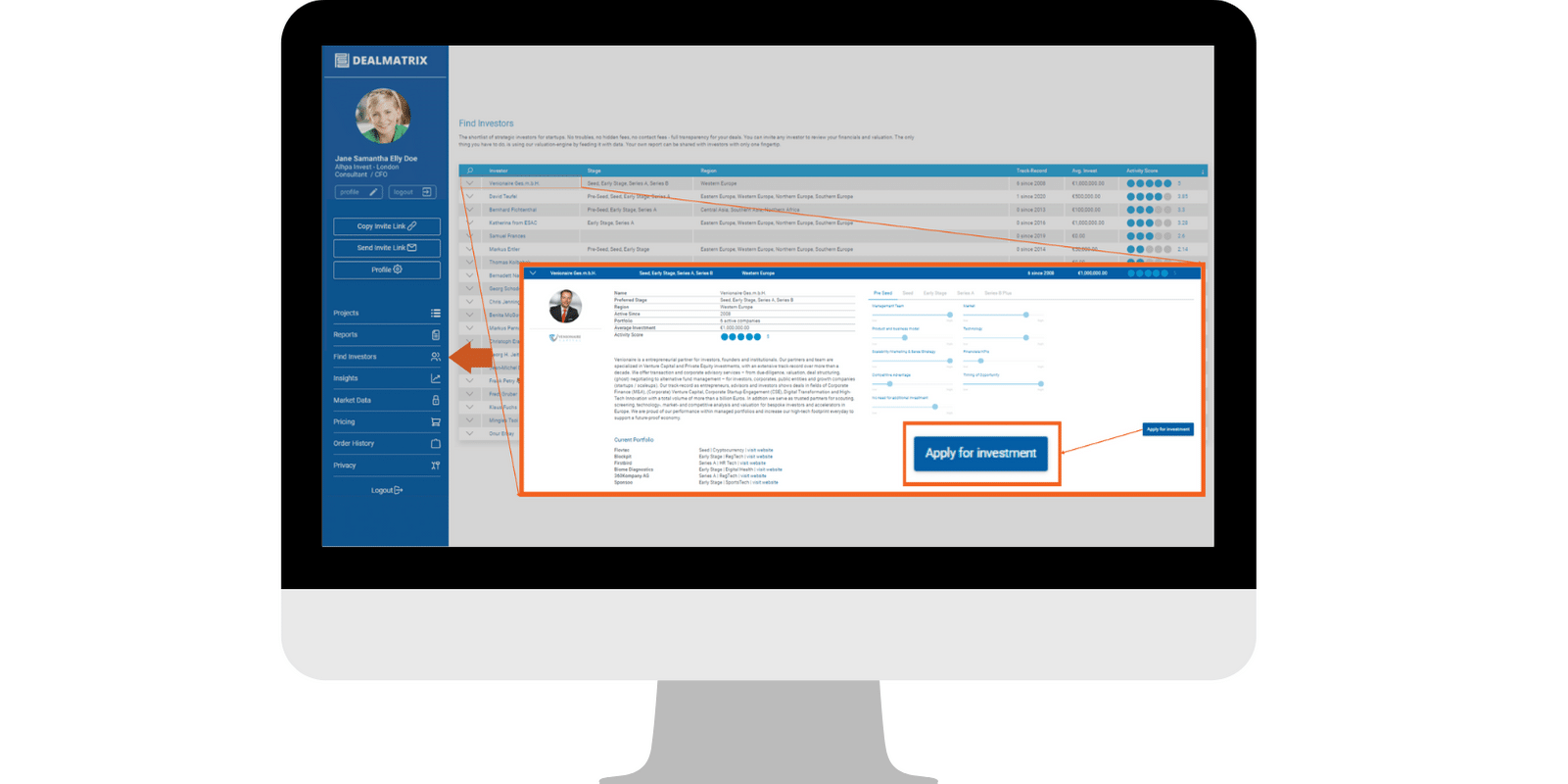

Users (with annual plans) may connect with investors and share their reports with them. On the home screen of DealMatrix, there is a menu on the left side of the screen and a button ‘’Find Investors’’.

By clicking on it, you will open a list of public profiles of registered investors and consultants on the platform. Other users can search investors and consultants by their:

- name,

- stage of focus,

- region,

- track record,

- average investment size

- activity score.

To search, press the magnifier icon on the top left corner of the table.

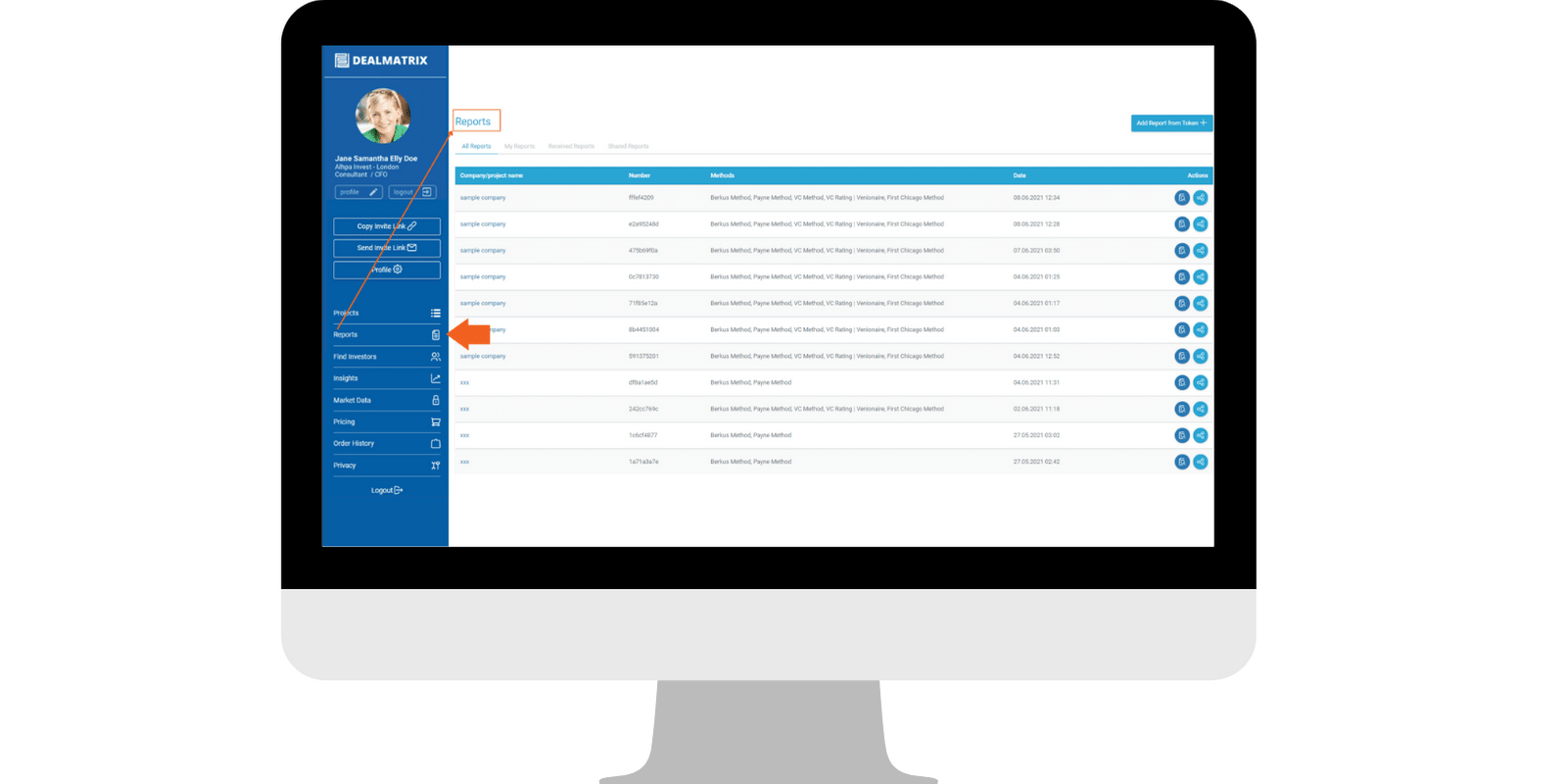

Share and Receive Reports

Each report that you generate can be shared with your business partners or investors directly via DealMatrix. To share a valuation report, enter the “Reports” section in the menu on the left side of the screen, press the “Share” button on the respective report, and type in the email addresses of your collaborators.

Earn Free Credits (Airdrops)

Dealmatrix encourages active usage of the platform and rewards you for sharing reports and for inviting new users to the platform.

You can invite investors to review your reports to get credits. And investors get credits for inviting startups too – by using their personal link – when logged in to DealMatrix Engine.

Pricing & Credits

- To get access to valuation software and a growing network of active investors and consultants, register for Free and get 3 Free Credits for generating and sharing reports.

- It takes 1 credit to generate 1 report, sharing reports is free of charge.

- Upon receiving a report, the invited person can make changes to the project to adjust the inputs according to their personal preferences and understanding.

- It takes 1 credit to adapt a report, but when someone receives a report, they get 1 credit for free.

Notification will help you to keep track of your (co-)investors, and this is notably much better than getting lost in their inboxes without feedback.

We wish you all the best for your venture and hope you will find transactions much easier using our tools!

![Startup Growth Pains: How To Handle Them? [Tips For Startup Founders]](https://dealmatrix.com/wp-content/uploads/2021/11/DM_Blog_Images-13-500x383.png)